Vietnam investment: Familiar faces

Regional private equity firms are refocusing on Vietnam, widening the exit options for local GPs that specialize in bringing companies to scale. But sizeable deals are scarce and valuations are rising

"Like a good marriage, it doesn't come easy. If you can get through difficult times by working together I think you find what is most valuable in private equity: trust between partners who respect each other for the different things they bring to the table," says Hans Christian Jacobsen, managing partner at PENM Partners. "It doesn't mean you can't disagree, but if you find someone who listens to you then you are more likely to want to keep working with them."

PENM's marriage to Masan Consumer Corporation (MCC) began in 2008 when the company – then known as Masan Food – was reporting annual revenues of less than $100 million from a range of sauces and seasonings. However, the private equity firm bought into the founder's vision of a business that could sell branded goods to local consumers at affordable prices, and on a large scale.

MCC is now part of local conglomerate Masan Group, which generated VND45.1 trillion ($1.98 billion) in revenue last year. PENM's second fund invested approximately $50 million in several Masan entities between 2008 and 2009, converted its interests into shares in the parent, and completed the last in a string of partial exits in April by selling a $100 million position to KKR. The overall return is more than 5x and the GP still holds shares in the company through its third fund.

PENM isn't the only GP to profit from the Masan story. The likes of VinaCapital, Mekong Capital, Goldman Sachs and TPG Capital have all invested at different times. And KKR is now embarking on its second marriage with Masan. It committed $359 to MCC in 2011-2013, exited last year, and then won a competitive process to invest $150 million in agriculture business Masan Nutri-Science. KKR also bought PENM's shares in the Masan Group because it thought the parent was undervalued.

"We are backing a counterparty we know and trust and like, and that is an important aspect of a deal. Vietnam is similar to China in terms of its opacity and how small some of the players are, and so we have to size our risk appetite for the opportunities and market. We have a very high bar for counterparty risk as well as the type of investment we go into – not just the sector but also the terms," says David Tan, a director at KKR.

This preference for familiar bedfellows is not unusual in Southeast Asia's still nascent markets, where corporate track records are unproven. A recent spate of investments by regional players like KKR underlines the renewed interest in Vietnam but the nature of the targets also reflects the relative scarcity of companies with the requisite size and sophistication – and this is putting upward pressure on valuations.

Bouncing back

The revival in country's fortunes is linked to its relative stability. Six years ago Vietnam was recovering from the effects of the global financial crisis while beset by a property market crash, a jittery banking system, and hyperinflation. Today the government is credited for keeping the currency stable and pushing ahead with economic reforms. There is also growth and rising entrepreneurialism.

"Across ASEAN there are young populations, rising disposable incomes, and consumption upgrades – and perhaps in Vietnam in particular. It has the region's third largest population and has been growing at over 5% for the last 25 years," says Ralph Keitel, principal investment officer in the PE and investment funds department at the International Finance Corporation (IFC). "It's also a small deal market, with a young private sector and lots of SMEs [small and medium-sized enterprises]."

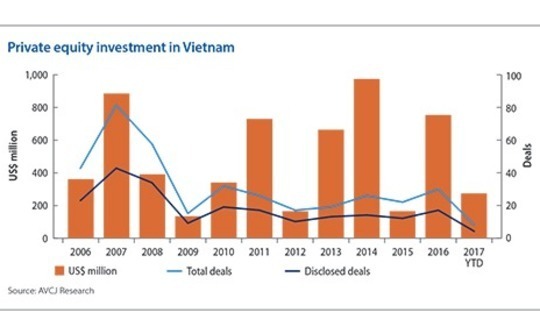

Headline investment numbers offer limited insight into the full extent of private equity activity in Vietnam due to the disproportionate impact of these rare large-cap deals. For example, 2016 was the third-biggest year on record with $759 million deployed, but much of that was GIC Private's investment in Vietcombank. Moreover, the percentage of announced deals for which the valuations are not disclosed is among the highest in Asia.

Another private equity investor who currently holds an education business in Vietnam notes that international school assets regularly change hands for double-digit multiples – Nord Anglia Education, a global operator that owns the British International Schools Group in Vietnam, was trading at about 14x adjusted EBITDA for 2016 prior to the submission of a take-private bid last month. Nevertheless, he admits there is certainly no shortage of demand for schools in Vietnam.

Navis Capital Partners is also a regional player on the acquisition trail, having completed the purchase of Hanoi French Hospital last summer following a two-year pursuit. David Ireland, a partner at the firm, describes the pace of investment as measured – Navis has completed four deals in Vietnam, with the first coming in 2008 and two more in 2012 – adding that there are plenty of non-intermediated opportunities for those with a presence on the ground.

"For non-intermediated deals, valuations are an issue because the vendors think that 7% GDP growth is going to last forever. Then sometimes a company will get the right advisor, the deal will be packaged together nicely, everyone will hear about it and they will end up getting an even better price," he explains. "But sometimes you don't see any competition. A lot of Vietnam deals have complexity; vendors are not easy to deal with, accounts aren't easy to comprehend."

Indeed, the Navis approach to deal-sourcing appears to attach an importance to known quantities similar to that of other pan-regional players. Two of the four companies, luxury furniture business Theodore Alexander and Hanoi French Hospital, were previously owned by foreign investors, while a third, OPV Pharmaceutical, was founded by a family that spent years outside of Vietnam.

Likewise, Standard Chartered Private Equity made four investments in Vietnam between 2014 and 2016. It got comfortable with mobile wallet platform MoMo and children's media business N Kid because of the quality of the founders – described as overseas educated Vietnamese with a clear understanding of what institutional investors want to see. The other two, agribusiness An Giang Plant Protection and restaurant operator Golden Gate, both previously had private equity backers.

Secondary pipeline

In this sense, rising interest from regional and global private equity investors has opened up an exit channel for local GPs that didn't really exist until recently. For example, Mekong's 22 exits to date include six trade sales, six public market sales, seven buybacks by founders, and three sales to other PE investors.

Two of those three – Golden Gate and VAS – came within the last three years, while the GP part-exited Mobile World to CDH Investments in 2013 ahead of a domestic IPO. It's a trend that is making all local managers more aware of how larger private equity firms might see them as an ideal vendor.

"We go into opportunities a lot earlier than the regional and global guys," adds David Do, managing director at VI Group. "The challenge for us is getting companies to a point where they are of a size and have a consistency in terms of performance such that they are investable by these bigger guys."

VI Group also has exposure to the education space, having invested in a school operator with an existing campus in Hanoi and supported the construction of a new facility in Ho Chi Minh City. The private equity firm teamed up with a local real estate developer to secure attractive locations and handle the construction, but then had to expend time and resources on the operational side, getting regulatory approvals, developing the curriculum, hiring teachers, and recruiting students.

As one regional investor observes, "I'm happy to buy from these guys because I can't replicate what they do on the ground in terms of bringing local businesses up to another level." However, a lot of skill also resides in picking management teams that have not only the right business models but also the ability to build companies that will appeal to institutional players, whether these are larger PE firms or public markets investors.

On one level, this is simply a matter of trust. Andy Ho, managing director and CIO at VinaCapital, asks two initial questions when considering an investment. First, does the company have the potential to develop brand equity, distribution channels, and scale that would make it of interest to a trade buyer? Second, can management deliver on a reasonable business plan and maintain an alignment of interest with shareholders (or to put it another way, they won't steal the assets)?

"The number of people with the experience to run companies is limited; often we have to look at multinationals who have trained up individuals," Ho explains. "If there is a supply-demand imbalance, you have to pay a lot for good management teams. Rather than take that expensive step – which could also cause a cultural shift in the business – I would focus on companies with good management teams, take a minority position and grow the business with them."

Mekong also places a great deal of emphasis on identifying founders with entrepreneurial instincts and the capacity to make these instincts work at scale by adding management talent around them as the company grows. This often means backing groups with previous experience running businesses together; the firm's most recent investment is a local express delivery services provider set up by a team that sold a nearly identical business to Kerry Logistics four years ago.

Initial meetings with companies might barely cover the market opportunity, but instead focus on the quality of the existing management and plans to develop it. "While every company tells you it is committed to building its management team, we've found out the hard way that it doesn't always happen," says Chris Freund, managing partner at Mekong. "Team building capability is one of the key screening criteria we use to assess whether we want to continue beyond the first meeting."

The private equity firm has distilled the lessons learned over the past 15 years into a standardized 14-point investment framework that is used to track the progress of all portfolio companies. Six of the 14 points involve recruiting and retaining talent and the use of external resources, including the appointment of independent directors, the use of outside experts, and visits to industry peers with a view to absorbing international best practices.

Much of this is drawn from approaches that worked out well with Mobile World, which Mekong first backed it in 2007. The retailer has grown from seven to more than 800 stores and employs nearly 30,000 people under a 95-strong senior management team, but it is still regarded as an exceptional case in Vietnam. A recent Mekong event in which the CEO and human resources director of Mobile World offered insights into their corporate culture attracted a crowd of nearly 550, most of them top executives from local companies.

"A lack of talented and experienced managers is probably one of the limiting factors right now. You don't have much apart from a young generation of entrepreneurs who have spent time overseas," adds IFC's Keitel. "From a GP perspective, it requires more hand-holding. Owners might not be willing to sell control, but recognize they need help on governance and some aspects of management. GPs must have the skill sets to add that value."

The consensus view is that conditions are improving. There is still a shortage of quality managers – investors find that senior executives often conform to one of two stereotypes: the 50-year-old who has emerged entirely within the confines of the state system and the freewheeling entrepreneur whose appetite for risk knows no bounds – but the younger generation is pushing through. From Golden Gate to N Kid, overseas returnees are building companies that GPs want to back.

At the same time, the youth of Vietnam's private sector means that businesses have yet to become multi-generational entities as is the case in other parts of Southeast Asia. The system was largely locked down until the 1990s and the subsequent release of that pent-up demand has facilitated the emergence of founder-entrepreneurs who are very much in hyper-growth mode. In this context, the parallels with China 10-15 years ago are relevant.

"I see another wave of medium-sized companies coming through. We have some in our portfolio that we've taken from $30-40 million in sales to $200 million over three or four years," says PENM's Jacobsen. "This is the next generation of businesses: fast growing, high margin, young management, and able to evolve in a completely different way to what we have seen before."

VinaCapital's Ho is equally bullish. Masan represents one of the firm's most successful investments, but he talks about backing groups that can become the next Masan. He cites An Cuong Group as an example. The company, which manufactures laminate panelling for the domestic and export markets, has doubled its profit since VinaCapital invested last year. Turnover came to approximately $70 million in 2015 and Ho believes An Cuong can become a $1 billion business.

Delicately poised

Companies are already entering the mid-market space where they become targets for investors writing $50 million checks, and it is only a matter of time before this translates into greater large-cap deal flow. Based on the current environment, private equity firms are likely to become an even more important part of the exits picture, alongside strategic buyers from within Asia.

The question left hanging is whether the rising valuations are symptomatic of a bubble waiting to burst. Vietnam has a track record in this area, notably in 2007 when capital flooded into the private equity deals with a view to quick flips into then buoyant public markets. The subsequent collapse left many investors out of pocket.

Drawing comparisons between the two periods is not straightforward. Ten years ago, the contagion was broader, the market shallower, and the factors somewhat different: there was insufficient entrepreneurial activity to satisfy demand for deals, which pushed up prices across the board; and public markets that had been stoked by local investor fervor were not mature enough to handle the fallout. This time around the choke point for private equity is a lack of deal flow at the top end of the market; other segments have yet to see the same kind of pressure.

Nevertheless, Vietnam does seem hardwired to volatility. "The highs are too high and the lows are too low, it's either euphoria or this is the worst country on Earth, when actually it's an emerging market that has ups and downs," says Navis' Ireland. What investors are hoping for is a trend towards moderation, supported by the country's strong fundamentals, more robust legal and financial institutions, and increasing exposure to international practices.

"The difference between peaks and troughs is smaller than before," says Do of VI Group. "I have no doubt we will go through a trough at some point in the next two years – who knows, we might get there sooner, depending on what happens globally – but Vietnam's economic base is definitely more stable. The macro situation is healthier and the industrial base is larger."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.