Renminbi fundraising: Policy power

The launch of several huge government-backed funds has skewed renminbi-denominated fundraising in China. What does their arrival mean for valuations and for the nascent independent LP community?

Qiming Venture Partners is one of a select group of Chinese VC investors that have both a decade-long track record and a strong institutional investor following. The firm has $2.7 billion in assets under management, but even seven years ago, with only two US funds and about $500 million at its disposal, Qiming could count the Princeton University endowment and the Robert Wood Johnson Foundation among its LPs.

That was when the GP decided to raise a renminbi-denominated fund. China had taken various steps to create a domestic private equity industry, notably launching ChiNext, a NASDAQ-style board in Shenzhen that allowed fast-growing private companies to go public under flexible listing standards. Qiming wanted a piece of the action and duly set out to raise RMB250 million (then $36.6 million). However, finding qualified renminbi LPs proved difficult.

"Most Chinese LPs were high net worth individuals (HNWIs), in addition to a few local government guidance funds with specific investment terms and conditions," says Janet Yu, a partner at Qiming. "Fortunately, the NDRC [National Development Reform Commission] launched a scheme to support independent VCs. We were in the first batch of GPs to receive its backing and successfully closed our fund. Without the government as an anchor LP, we might have had to find more HNWIs."

The NDRC and the Beijing government contributed 40% of Qiming's first renminbi fund, most of which went into biomedical investments. Six years on, the VC firm closed its fourth local currency vehicle at RMB1.5 billion, continuing a steady increase from RMB605 million for Fund II and RMB1 billion for Fund III. The LP base is broader and more sophisticated, including fund-of-funds launched by Noah Holdings and CreditEase, Tsinghua University, the Chinese Academy of Sciences, and several insurers.

The Qiming transition offers a snapshot of a Chinese LP landscape that is increasingly diversified and less government-driven. But this is not borne out by the headline numbers. In 2016, the government again took center stage, announcing several mega funds, albeit with a view to channeling money into the industry through more organized and professional channels. Is Beijing laying the ground for a more balanced system or simply throwing capital at its problems, sparing little thought for long-term sustainability?

Twin peaks

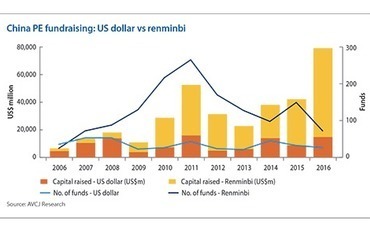

China PE fundraising has seen two peaks. One was reached in 2011, when $52.8 billion poured into the asset class, 70% of it entering renminbi funds as HNWIs pursued multiples arbitrage opportunities on ChiNext. For many it proved a fruitless endeavor and they abandoned private equity. The second came last year, with $79.7 billion raised, and an extraordinary 80% of commitments going to renminbi funds. In the absence of a meaningful number of HNWIs, the government role has been magnified.

The largest renminbi fund raised between 2006 and 2011 was the Innovation Industrial Investment Fund, which closed at $4.18 billion in 2011. It was launched by Shanghai Creative Industries Demonstration & Service Platform, a local government-connected entity, and tranches of capital were allocated to a variety of GPs, including Sequoia Capital. A cluster of other local government-backed funds also achieved final closes, but none reached $1.5 billion.

In contrast, between July and September of 2016, three state-sponsored renminbi funds together received around $39 billion. Exclude this trio of vehicles from consideration and the local currency total is just $25.6 billion, below the $33.8 billion raised in 2015. The number of funds achieving a partial or final close last year was 72, down from 150 in 2015; in 2011 it was 267. Even if the LP landscape is becoming more diversified, those investors are clearly picky – but the reality is that the government is skewing the overall picture.

The government-backed guidance funds of a decade ago were established in particular locations such as Beijing's Zhongguancun district, which was earmarked as a technology hotbed and so the local authorities wanted to encourage inbound investment. A similar principle is now apparently being applied on a national scale.

Premier Li Keqiang last year announced a slew of policies to encourage entrepreneurship, including a RMB40 billion ($6.5 billion) government-guided VC fund for start-ups in emerging industries. It is one component of an effort to achieve multiple goals: bolster a slowing economy; accelerate the transition from investment and export-driven growth to a consumption and services-led model; reduce dependency on heavy industry; and achieve efficiency through innovation in emerging industries and restructuring of traditional ones.

"The government faces a lot of challenges from traditional industries and it also wants to develop a new economy," says a senior executive at Qianhai FoF, a renminbi fund-of-funds set up by the former chairman of Shenzhen Capital Group. "It is difficult to stimulate one or two sectors, and the government can't rely on Alibaba Group or Tencent Holdings to create this new economy. Many sectors such as tourism, entertainment and media must be addressed, so the government is adopting a top-down approach driven by fund managers."

At the same time, the National Venture Investment Guiding Fund for Emerging Industries is not actually a single fund. The RMB40 billion represents the central government's budget for the venture capital industry. The Ministry of Finance (MoF) is responsible for the asset allocation and it will team up with independent fund managers to launch fund-of-funds. These managers are selected through a bidding process, although there is a preference for groups that have government ties.

The MoF has so far made commitments to three fund-of-funds, pledging RMB10 billion to each one as an anchor LP. They are managed China International Capital Corporation (CICC), Infotech Ventures, and State Development & Investment Corporation (SDIC). The GPs then raised capital from other LPs. CICC, for example, reached a final close of RMB40 billion on its vehicle after signing up the NDRC and some private investors. Industry participants expect the fund-of-funds GPs will earmark some capital for direct PE investments and buyouts, in addition to fund investments.

"The anchor LPs in these government-backed funds and the managers receiving capital are quite consistent with six years ago," says one GP. "What has changed is how they work together. In the past, the MoF was the sole LP in partnerships with GPs – and the government only paid management fees, not carried interest, because some investments were policy-driven rather than market-oriented, resulting in poor results. Now, with the participation of independent LPs, GPs are incentivized to invest more commercially. The returns will be split between the GPs and LPs, including the government."

The professionals

It is estimated that there are now around 1,000 renminbi fund-of-funds in China and 60% of them have state support, with total assets of RMB1.5 trillion. Whether initiated by the central government or local authorities, a common theme is leveraging social capital for investment in various sectors. The remaining two of the big three from 2016 are both intended to address state-owned enterprise (SOE) restructuring.

The first is a RMB200 billion VC fund launched by government-owned state asset manager Chinese Reform Holdings, which reached a first close of RMB100 billion last August. The following month, the State-owned Enterprises Restructuring Fund (also known as China Structural Reform Fund) raised RMB131 billion towards a target of RMB350 billion. Established by Chengtong Holdings, it focuses on cross-border investment aimed at boosting SOE competitiveness. LPs range from banks such as China Postal Savings Bank to corporates like China Petroleum & Chemical Corp.

Chengtong, itself an SOE, has hired Xiangming Fang, who previously made private equity investments for China Re Asset Management, to manage the China Structural Reform Fund. This movement towards professional management arguably began with Oriza around 2014. It began life as Suzhou Venture Group, a government-owned GP, but was then reconfigured as a market-driven fund-of-funds, receiving LP commitments from large SOEs and China Development Bank. Appointing experienced executives was a logical next step.

In this way, the line between government and non-government is becoming blurred in some corners – indeed, professionalization is a prevalent theme everywhere. Institutional participation in private equity has grown on the back of deregulation, with insurance companies, corporations and even endowments putting more capital to work in the asset class. On the retail side, the government clamped down on illegal fundraising and unqualified individual investors. HNWIs increasingly access PE through fund-of-funds managed by the likes of Gopher Asset Management, an investment arm of Noah, and CreditEase.

The net impact is that more capital is available from an increasingly sophisticated set of LPs. Foreign private equity firms best known for managing US dollar funds have taken notice. A number of GPs – particularly from the VC space, with GGV Capital the most recent high-profile example – are looking to raise renminbi vehicles or enlarge existing pools of local currency capital.

There is an investment rationale as well. Plenty of private equity firms raised US dollar and renminbi vehicles in the previous boom period, driven not only by the availability of capital, but also by the restrictions China places on foreign investors. Not all industries are open to offshore funds, and investments made in those that are subject to additional, time-consuming approvals processes. GPs can expect to receive particular scrutiny when targeting areas such as media and content production and online financial services.

Moreover, if it is thought that a portfolio company can achieve a higher valuation by listing on one of the Chinese bourses rather than overseas, renminbi capital may make more sense for regulatory and practical reasons. The government has sought to improve the quality of the capital markets in recent years, including the introduction of the New Third Board, which means GPs can achieve liquidity events but with looser compliance requirements.

"It's not difficult for established US dollar fund GPs to raise renminbi funds," says Dayi Sun, managing director at US dollar fund-of-funds Jade Invest. "The entry barrier for GPs raising first-time renminbi funds from institutional investors will become higher as more teams spin out from internet companies and from established PE and VC firms. But it also becoming more difficult for government-backed fund-of-funds to pick the right fund managers as they're not as well-trained as foreign institutional LPs."

Costly competition

A natural consequence of these favorable policies in China is increased competition for deals. "Is there too much renminbi capital chasing a limited number of deals?" the Qianhai FoF executive asks. "I think that issue is always there."

Competition has certainly intensified in the renminbi space, with more angel investors and institutional LPs pumping capital into the system from early-stage to late-stage deals. Banyan Capital, a younger generationW Chinese VC firm that spun out from IDG Capital, closed two renminbi funds shortly after its US dollar vehicles. It operates under a two-pronged strategy intended to offer access to the best deals.

The question posed by the influx of government capital entering the industry is whether it will exacerbate this phenomenon: more GPs are able to raise funds and the dry powder agitating to be put to work drives up valuations. Ken Xu, partner at early-stage investor Gobi Partners, observes that the number of high quality Chinese start-ups is not growing at the same pace as the pool of capital seeking to back them. As a result, inexperienced GPs back companies that are unviable, resulting in huge losses for the government.

"The government will seed many new GPs in the renminbi space. It will create more competition, but I think the impact will still be limited. Over one or two cycles, many of these GPs will suffer losses and then disappear because high quality companies only want to work with the most reputable GPs," he says. "From that perspective, new GPs or purely government-backed funds can't compete effectively against longstanding commercial GPs with strong track records on the US dollar and renminbi sides."

There is also an innate lack of predictability around government policy. The capital could dry up due to poor performance, loss of interest or change of personnel, or simply a shift to other forms of support – and perhaps several years later it comes back again. The concern is not only that government-backed funds artificially extend an existing period of inflated valuations, but also that the lessons are not learned and a policy-driven boom-and-bust cycle is repeated.

What remains to be seen is whether the government funds can contribute to the maturation taking place in the wider LP landscape. If, for example, CICC receives seed funding for a fund-of-funds from the MoF and then raises more from independent sources, is an ecosystem being created that otherwise would not be there? And, by extension, can the emergence of independent domestic LPs minimize the volatility created by government policy, in the medium if not the short term?

"We are looking at other institutional LPs, including pension funds, insurance companies, and other market-driven fund-of-funds. Another group of emerging LPs is the banks," says Yu. "Government-backed funds can attract more capital from different sources into private equity. But they are only part of the wider LP community – their in-and-out approach will not impact the growing prospects of renminbi funds."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.