Oriza Holdings

Top Chinese semiconductor investor released from detention

Datong Chen, co-founder of WestSummit Capital and one of China's foremost semiconductor investors, has been released by local authorities after eight months of detention.

Singapore's Virtue Diagnostics closes $100m Series B

Singapore-based Virtue Diagnostics, a clinical testing equipment supplier for China and developing markets, has raised a USD 100m Series B round led by Sequoia Capital China and Morningside Ventures.

China community group buying platform Tongcheng Life goes bust

Tongcheng Life, a China-based community group buying business incubated by online travel agency Tongcheng-Elong, has announced its bankruptcy, blaming "poor management."

Lilly Asia leads $90m round for China's Duality Biologics

Lilly Asia Ventures has led a $90 million Series B round for Duality Biologics, a Chinese developer of oncology and autoimmune drugs.

China's JW Therapeutics trades up after $300m Hong Kong IPO

JW Therapeutics, a private equity-backed Chinese drug developer specializing in CAR T-cell therapies that engineer immune cells to fight cancers, has raised HK$2.33 billion ($300 million) through a Hong Kong IPO.

Everest leads Series A for Chinese map provider

Fengxing Zhitu, a subsidiary of Chinese courier company SF Express, has raised a RMB100 million ($14 million) Series A round led by Everest Venture Capital. Oriza Holdings, Maison Capital, and Jade Capital also took part.

China's CF PharmTech raises $90m Series E

CF PharmTech, a Chinese devices maker focused on respiratory health, has raised $90 million in Series E funding led by local private equity investor New Alliance Capital.

Chinese auto parts supplier raises $28m in Series A extension

Mancando, an automotive parts supplier based in Guangdong province, has raised RMB200 million ($28 million) in an extended Series A round led by Legend Capital, with participation from Eastern Bell Venture Capital, Galaxy Capital, and Oriza FoF.

Chinese e-commerce sourcing partner xyb2b gets $100m

Xyb2b.com, a B2B platform that helps Chinese e-commerce companies source products from overseas, has completed an extended Series B round of funding worth $100 million.

SDIC, Sherpa lead $74m round for China's EpimAb

Shanghai-based biopharmaceutical company EpimAb Biotherapeutics has raised a $74 million Series B round led by SDIC Fund Management and healthcare specialist Sherpa Healthcare Partners.

China supply chain solutions provider gets $356m Series A

Shenzhen-based Zhunshida, or Jusida, a logistics spin-out from Foxconn International, has raised RMB2.4 billion ($355.8 million) in Series A funding led by China Life Insurance.

Tencent-backed Tongcheng-Elong gains 26% on HK debut

Tongcheng-Elong, a Chinese online travel services company backed by Tencent Holdings, Ctrip and local PE player Ocean Link, surged on its Hong Kong trading debut following a HK$1.62 billion ($207 million) IPO.

China's Data Grand raises $23m Series B round

Data Grand, a Chinese natural language processing (NLP) solution developer, has raised RMB160 million ($23.1 million) in a Series B round of funding led by Chenshan Asset Management, an arm of Chinese venture capital firm China Broadband Capital.

Legend, Tiger back Chinese industrial e-commerce platform

Legend Capital and Tiger Global Management have led a $129 million Series C round for Zhenkunhang, a Chinese e-commerce platform that specializes in industrial products.

China's Ascentage Pharma files for HK IPO

Ascentage Pharma, a Chinese biopharmaceutical company with several private equity backers, has filed for an IPO in Hong Kong.

China's Ascentage Pharma gets $150m in Series C funding

Ascentage Pharma, a Chinese biopharmaceutical company primarily focused on treatments for cancer, has raised $150 million in Series C funding.

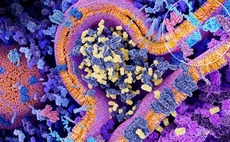

Chinese biotech firm Biocytogen raises $65m

Biocytogen, a Chinese contract research organization (CRO) that provides genetically engineered mice for drug testing, has raised RMB410 million ($65 million) in a Series C round of funding led by CMB International Capital, an investment arm of China...

China's JW Therapeutics gets $90m Series A round

JW Therapeutics, a China-based clinical stage biopharmaceutical company, has raised $90 million in a Series A round of funding led by Temasek Holdings, Sequoia Capital China, and Yuan Ming Capital.

China AI chipset maker Cambricon raises $100m

Cambricon Technologies, a Beijing-based artificial intelligence (AI) developer, has raised a $100 million Series A round of financing from Lenovo Capital & Incubator Group (LCIG), and an investment unit owned by Alibaba Group.

Oriza Seed leads $25m Series A for Shanghai biotech firm

Oriza Seed Venture Capital, an early-stage and growth-stage investment unit under China’s Oriza Holdings, has led a $25 million Series A round for EpimAb Biotherapeutics, a Shanghai-based biopharmaceutical firm.

China's UCloud secures $140m Series D

Chinese cloud computing services provider UCloud has raised RMB960 million ($140 million) Series D round of funding from Oriza Holdings and CICC Alpha, a direct investment arm of China International Capital Corporation (CICC).

Private equity-backed SF Express lists in Shenzhen

China’s largest express delivery services provider SF Express, which is backed by several PE investors, has completed a backdoor listing in Shenzhen that values the business at RMB43.3 billion ($6.6 billion).

Renminbi fundraising: Policy power

The launch of several huge government-backed funds has skewed renminbi-denominated fundraising in China. What does their arrival mean for valuations and for the nascent independent LP community?

China's PE-backed Tongcheng merges with Wanda Tourism

Chinese conglomerate Dalian Wanda Group has spun out its travel-related assets and merged them with a subsidiary of Tongcheng Network Technology, a PE-backed online travel platform. The aim is to create China's largest online-to-offline (O2O) travel business....