Asia PE and upstream energy: Under the pump

Although a low oil price environment has created interesting inroads for PE investors seeking exposure to Asia’s growing energy consumption story, challenges of timing and targeting have slowed uptake

The recent actions of two US-based PE firms, The Blackstone Group and Simmons Private Equity, say much about the evolving investment opportunity for Asian oil and gas in a low commodity price environment. The former pulled out of an $800 million project development effort in Malaysia due to difficulty sourcing deals in the region, while the latter quietly scored an acquisition in the same country, but one that is geared more toward operational efficiency than expanding output.

The Blackstone plan, launched in mid-2014 before the oil price plunge, was focused on growing an asset base in Southeast Asia through Tamarind Energy, an entity created by former executives at Canada's Talisman Energy. The move envisioned partnerships with national oil companies (NOC) that would leverage Talisman's expertise in maximizing production as energy demand in the region grew in step with a number of socioeconomic trends. Blackstone retreated in August, however, without making any investments.

While the Simmons deal follows a comparable premise related to supporting existing producers, the focus is on helping control costs than closing the region's demand-supply gap. Specifically, the firm paid an undisclosed sum for subsurface consulting company Leap Energy with plans to grow a portfolio of complementary upstream advisors.

This traction suggests that weak oil prices are creating opportunities for investors to work with NOCs and locally established supermajors that need to address cost pressures. At the same time, the contrast of Blackstone's setback amounts to a warning about the challenges related to the long-term nature of the industry and the importance of an approach finely targeted on the needs of entrenched regional players.

"When both capex and opex are being monitored very closely as they are in the current climate, making production from late-life or brownfield assets more efficient is key to exploration and production companies and therefore an area where you want to be," says Jeff Corray, managing director and head of private equity at Simmons. "For this reason, Asia and Southeast Asia in particular are very much in our line of sight. Leap not only covers this region well but addresses the challenges of making brownfield/late-life assets more efficient through their high end consultancy and proprietary software offering. It's challenging to invest when activity is lower, but there's a lot of opportunity here, and it's a good market ultimately for us to do business in."

Up and down

For the past two years, the global energy industry has been defined by the rapid fall in oil prices in late-2014. This saw the commodity tumble from a relatively steady $100-per-barrel valuation to a range around the $50 mark; it scraped as low as $30 a barrel earlier this year. No one saw the drop-off coming, although hindsight has allowed analysts to paint what should have been a predictable technology-driven curve. This narrative essentially tracks how Middle East export restrictions artificially inflated oil prices, encouraging alternative North American energy plays to redraw global crude trade flows by perfecting unconventional production techniques that would have otherwise been uneconomic.

The result has been an energy glut that has seen oil, gas, coal and uranium prices each hit lows that have proven crippling for many operators. In the upstream oil and gas space, development expenditure cutbacks created by this environment suggest that private equity could benefit from a number of opportunities for building up underinvested fields.

GPs are therefore calling this end of the oil price cycle a buyers' market for long-horizon investors. The view is reinforced by the notion that multinationals with restricted budgets are providing an opening to alternative buyers by declining to take a chance on even the most attractive of cash-strapped juniors. The reduced M&A competition is further exaggerated in Asia Pacific, where only about 5% of global upstream M&A activity is transacted, many NOCs have been conspicuously quiet in recent months, and some international corporates are reducing their regional footprints for budgetary reasons.

"There has been a lot more capital from buyers in Asia traditionally which has meant attractive deal flow has been a bit slower to emerge and there's been a bit of a lag in deal pricing. But you're now starting to see attractive deals across Australasia and Southeast Asia, so we're increasing the focus there," says Jason Cheng, managing partner at Kerogen Capital. "National oil companies in Asia still need to acquire assets in order to feed the growth engine. The long-run underlying dynamics haven't changed for Asian energy security, so we expect buyers to be back in the market in the not-too distant future."

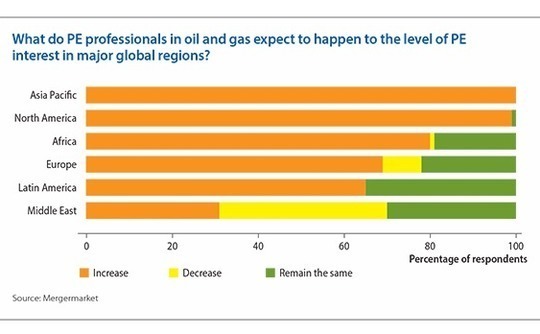

In a survey conducted by Mergermarket of 100 private equity professionals active in the oil and gas sector over the past two years, all 100 responded that they expected the level of PE interest to increase in Asia Pacific. This compared to 99% and 67% showings for North America and Europe, respectively.

"If you buy into a portfolio of oil and gas concessions at the wrong time in the cycle, you're not buying a group of assets - you're buying a collection of liabilities because you have to keep funding the appraisal and development commitments," says Mark Thornton, managing director of Indonesia Private Equity Consultants. "That can keep private equity investors on the sidelines until they're sure the oil price is starting to turn up again. For it to go back up to around $60 a barrel - that is where a lot of these projects start to look attractive in terms of upside potential - that still feels to be a few months away."

Services angle

As many long-term expectations for the oil price to remain in a $45-50 per barrel range have hardened, the primary deal flow driver has reverted from absolute distress to a more strategic portfolio rationalization process. As such, the corporate carve-ups that had been envisioned as creating asset fire-sale opportunities in the region did not gain much traction in 2015. Investors as a result seem wary to commit to the sector, with Wood Mackenzie estimating the total value of Asia Pacific M&A activity in oil and gas as having declined 64% during 2015 to $5.4 billion.

"Although the bid-ask spread has slowly narrowed, we have not seen sufficient distress to date to drive a buyers' market," Wood Mackenzie oil and gas researchers Angus Rodger and Ashima Taneja told AVCJ, adding that Asia Pacific M&A activity for the current year had only reached $4.2 billion in value so far. "That said, we expect more deal flow over the next few months as the majors across Asia Pacific look to offload more mature and non-core assets to ease pressures on balance sheets and aid global divestment targets."

As this scenario of slowly increasing but still carefully controlled deal flow unfolds, GPs may have to contend with higher pricing than expected and extend considerably more than growth capital as part of their value-add proposition. In this context, Simmons' strategy of offering tailored solutions to a company in need rather than simply attempting to exploit the macro imbalances of the sector comes into clearer focus. Indeed, the firm's latest acquisition was planned as the first step in forming a global consulting group that would bundle together niche service providers able to realize essential operational optimizations for oil and gas companies experiencing commodity price-related stresses.

In the case of Leap Energy, which maintains offices in Malaysia, Indonesia, Australia and Europe, this chance to expand internationally while keeping its core leadership intact presented a compelling alternative to being absorbed by an industry conglomerate. The deal could be seen to exemplify the advantage private equity investors have over corporate competitors where ambitious juniors are seeking inorganic growth in a downturn.

"We were approached a number of times in the past by other parties, but it was the specific expertise in the oil and gas sector brought to the table by Simmons, who have successfully taken consultancies to the next level, that attracted us to them," says Arnout Everts, Leap Energy's technical director. "We were comfortable with the business model we had, but we recognized there were limits to where we could take it without an investor behind us. We started thinking about laying the foundation for another growth jump as and when things pick up, and that's when Simmons knocked on our door."

The strategy includes a focus on diversification in technical specializations as well as geographic footprint. Leap offered Simmons additional knowhow in mature field production optimization and predictive analytics for conventional and unconventional reservoirs. In return, the PE was able to interest Leap with an opportunity to push further into the fields of geophysics, geo-mechanics and complex drilling.

The rationale behind an emphasis on geophysics ¬- including seismic processing - is based not only on the considerable contract values involved but also on the discipline's ability to create relationships with new clients as one of the first areas of focus in project development. Complex drilling and geo-mechanics, meanwhile, represent potentially viable investment targets since they offer a chance to leverage growth in the unconventional production methods used in late-life fields as companies scale back spending on the development of new reservoirs.

Be patient, very patient

PE investors are also seeing project acquisition advantages as a result of low oil prices weakening the services market. As overall operational activity pulls back and equipment utilization rates decline, doors are opening to develop projects with lower breakeven financial thresholds. Taking advantage of the effect of lower cost bases, however, remains a matter of timing.

"You need to find projects where you can maximize the impact of cost deflation in the near term, because once rigs are stacked and capacity is taken out of the market, subsector pricing will recover and increase," Kerogen's Cheng explains. "So your window to lock in cost deflation opportunities may only be a couple of years."

This window of opportunity reflects an industry consensus that a timeframe of about two years will be required for supply-demand stabilization and attractive exiting conditions to return. However, in the context of the longest oil price recession yet, this projection has come as cold comfort to many PE players. "LPs have been telling me they have no appetite for highly cyclical plays like oil and gas," says one PE professional. "No one seems to want to go near it on the listed side or the private side."

The universal hesitancy that this feedback implies offers a reminder of the sentiment-driven nature of the energy industry. In many respects, the cyclicality plays into PE's ability to ride out long turnaround periods with patient capital. But at the same time, it confirms that uncertainty about the timing of the cycle can be a game-changer for would-be partners, especially in light of industry expectations that 2017 will be the third consecutive year of capital expenditure cuts due to overall market weakness.

"It's going to take longer to come out of this recession, so we need to run the businesses as though they will always operate in this environment," Simmons' Corray adds. "We aim to buy and grow as aggressively as we can, but we are quite conservative in our assessment of the outlook for the next couple of years. We're not in the short game though - we are building proper businesses that address the needs of our industry, which we believe will be attractive at exit."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.