Portfolio: Creador and Indonesia's Simba

By acquiring Simba, Creador has entrenched itself in a small but fast-growing Indonesian cereal story. Now it will take logistical and marketing expertise to realize the potential of the local consumer market

Bubur Ayam, a rice porridge that is arguably the most typical of Indonesian breakfasts, only packs about 300 calories per serving, but its sodium content is twice that of a bowl of cornflakes, with 25 times the fat. Southeast Asia-focused private equity firm Creador recognizes the potential in this discrepancy well, especially in the context of an increasingly discerning and modernized Indonesian consumer base.

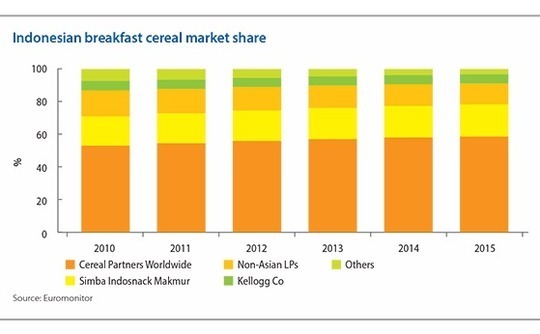

The firm made its first consumer investment in Indonesia in 2013 with the $35 million carve-out of Simba Indosnack Makmur from India's Godrej Consumer Products. At the time, the cereals and snack food supplier was generating net sales of $22 million and commanding a 17% market share.

According to Euromonitor International, this market share has ripened to 19.7% as of 2015 under Creador's stewardship, while most of the company's international competitors have stagnated or declined in Indonesia. Simba's only realistic challenger remains Cereal Partners Worldwide, a joint venture between industry giants General Mills and Nestle, which currently claims more than half of the local market.

The key to Simba's growth in recent years has been rooted in a familiar story of rising disposable income levels, with a more precise focus on trends in health consciousness and the rise of women in the workforce. Adding interest has been the primordial nature of Indonesia's commercial breakfast culture, with a largely rural population of 250 million continuing to default into a fatty bowl of bubur ayam and representing enormous upside to effective cereal marketers.

The domestic cereal market was estimated to be worth a mere $65.3 million in 2015, on par with Malaysia, which has only one-eighth of Indonesia's population. This figure, however, is expected to grow to $98.2 million by 2020, while Malaysia and other regional neighbors such as Singapore stagnate.

"It's clear that the penetration is still low in the cereal market. People are getting richer and busier, especially those living in the city, so they want something more practical, but at the same time, they want something healthier," says Stafanus Hadiwidjaja, executive director at Creador. "Cereal is perceived as - and is in fact - a healthier option for breakfast."

Health conscious

Simba produces corn-based snacks under its Turbo brand but the vast majority of the company's revenue comes from its breakfast cereal line, which includes names the likes of Choco Chips and Rainbow Hoops. While these kids' cereals would not be considered healthy breakfasts in most developed markets, they are seen as nutritious options in comparison to local fare.

Growing these brands in the context of a more modern Indonesia means leveraging their appeal as healthier foods to a population of women who are increasingly wealthy but have less time to make traditional meals. World Bank data indicate that 51% of Indonesian women were in the workforce as of 2014, compared to only 27% in India and 45% in Malaysia. This social momentum has coincided with the country's steady per-capita GDP march from about $2,630 in 2006 to $3,830 last year.

"We are still focusing on children, but we have to build into the larger market in Indonesia, starting with children and moving on to adults," Yovita Adipurna, Simba's brand manager, says. "A lot of people are developing healthy eating habits and there are more working moms who are looking for more practical ways to feed their children in a healthy way. To answer those kinds of needs this year, we are looking at more practical packaging and heavily pushing marketing activities such as pairing our products with milk."

Pairing cereal and milk in Indonesia is not as intuitive as it seems. Rural consumers tend to eat cereals by the handful like popcorn rather than in a bowl for breakfast. As increasing market penetration has been tied to educating the public on proper cereal consumption, Simba has benefited substantially from Creador's portfolio connections in the dairy space. An introduction was made to milk and yogurt producer Cimory Group, for example, and the two companies have since collaborated on television advertisements.

Simba also plans to introduce milk into the marketing equation with concepts such as a cereal that comes with powdered milk already in the box so that all that is needed is to add water. Other product launch ideas that have been floated include packaging with a re-sealable zipper and miniature boxes for taking to school. Such diversification ploys, however, are rolled out conservatively, with respect for the traditional nature of most consumer demographics in the country.

"We need to be very clear about where we want to go and what is the right product to better position ourselves because if you're talking about food as a consumer business, there are different kinds of products you can introduce," Hadiwidjaja says. "With our strategy, we're not trying to launch a whole new kind of cereal; we're trying to benchmark the products that are growing globally and then assess the opportunities in Indonesia based on local consumer tastes."

This approach involves applying savvy packaging and marketing techniques to internationally proven concepts. It is has been followed through under Creador with Rainbow Hoops, a version of Kellogg's well-recognized Froot Loops product that has been rebranded to tap a local preference for fruit flavors.

Another locally relevant factor in marketing is the country's inherent logistical difficulties as an archipelago with major shortcomings in practical infrastructure. Although recent traction on this front has been demonstrated with the World Bank's approval of a $216 million infrastructure funding package, practical developments do not always match investor enthusiasm. Power blackouts remain commonplace, sea shipping remains more expensive than land transport despite the island nature of the country, and relatively consistent weather-related phenomena such as heavy rains and minor earthquakes are regularly reported as disrupting what infrastructure already exists.

As such, Creador has to plan logistics as one of Simba's major budgetary concerns after the procurement of raw materials and marketing. "The goal is not only adding products but making sure we have a wider reach through better distribution," Hadiwidjaja explains. "Distribution is one of the things that's not easy to crack in a market like Indonesia, but once you can crack it, you have a good competitive advantage. We are actually just undergoing some changes in distribution and suppliers. It's still a work in progress."

Rural reach

Distribution, as it turns out, may be a key advantage for Simba. While the company is the number two operator behind Cereal Partners Worldwide in modern supermarkets, it is the biggest player in the traditional, rural stores that make up about 60% of the overall market. The company's focus on building distribution networks for these vendors - as well as its flexibility in offering products at a lower price - means that it is able to tap a huge portion of the market its international competitors have essentially ignored. This in turn offers Simba the bulk of the cereal market's upside.

"A global player like Nestle is mostly focused on modern channels, and the way they build distribution is really focused on serving the modern channel market with products targeting the middle and upper price segments," Hadiwidjaja says. "As local players, one of the key differentiations for us is we don't want to focus only on the modern channel, we want to expand our general trade business also."

Marketing advantages of being a local brand in the cereal game are limited as the products are generally expected to be global brands with international markings. However, overcoming Indonesia's infrastructure and distribution problems can benefit from local networking experience. Adipurna indicates that logistics knowhow could represent the deciding advantage in regions where advertising is difficult.

"We are also seeing the growth of the middle class and increasing incomes in the traditional market, so we've done a lot of sample testing which has been successful and we are launching a new product with larger packaging and a higher consumer price," he says. "We still have to educate people on how to properly eat cereal with milk, however, and promotion in that market can be difficult. For now, the traditional market will depend primarily on distribution only."

This distribution is currently being achieved by a staff of about 500 people across two manufacturing facilities. Most production is realized at a plant on the most populous island of Java, while a smaller plant in Kalimantan handles shipments for the other islands.

In the traditional market, output for a single product typically amounts to about 60,000 units per month, each of which includes 160 boxes or bags of cereal. Five brands are marketed to rural consumers, with these volumes across more than one million stores, but the competition is steeper in the modern markets where Cereal Partners Worldwide continues to dominate.

This segment is tied to the urbanization and technological proliferations that define much of Southeast Asia. In Indonesia, the opportunity can be assessed in the still relatively modest footprint of the biggest modern cereal vendors, Indomaret and Alfamart, which have some 22,000 combined outlets.

"I am seeing rapid growth in the modern trade markets, and since Simba was acquired by Creador, we've put a lot of strategy into this area," Adipurna says. "With Creador, we are more financially disciplined in spending, but we're still aggressively expanding in this market. We are planning to launch new products this year."

Micro and macro

Simba has not grown as quickly as Creador expected it would on acquiring the company. At least 18 months of economic turbulence have brought corporate advancements in Indonesia to a virtual standstill. The country's economy grew at its slowest rate in six years in 2015, and the growth in the first quarter of 2016 was flat at 5%. This is expected to persist over the coming months with a continuation of subdued household consumption metrics and a recently stronger rupiah pushing up the price of exports.

The potential to thrive during what is widely regarded as a temporary slowdown, however, can be found in another of Simba's unique advantages under private equity ownership. Although the company was Creador's first consumer investment in Indonesia, it was the firm's second overall investment in the country after MNC Skyvision, a pay TV operator with 70% local market share. As with the milk promotional work achieved through the Cimory collaborations, Simba is set to benefit from a deal with MNC that offers the company free advertising spots.

Meanwhile, the Asian Development Bank expects data to show a pick-up in private consumption during the second quarter, even if overall economic growth remains flat. This follows calls for a nine-month tax amnesty that could bring in about $12 billion to the national government as well as a $100 million commitment from China Fortune Land Development to develop industrial property in the country.

In this undulating near-term macro context, Creador is still patiently concentrating on growth, rather than planning an exit. This will likely reflect the same slow but dependable value creation that typifies Indonesia's macroeconomic story as niches of locally particular upside are exploited with cautious, precision interventions.

"The consumer story in Indonesia is well known, but to be more specific, we like fast-moving consumer goods [FMCG] as a sub-sector, and if you go even deeper, food and beverage is one part of FMCG where we like companies with a strong brand and a clear growth story," Hadiwidjaja says. "For Simba, there is changing consumer behavior as well as the need to have a healthier, more nutritious product for daily consumption."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.