Articles by Brian McLeod

Walden's chief on making 11 exits in 15 months

Consistent concentration on core investment values is at the heart of their conspicuous success

The economic impact – and opportunity – of disaster

MORE THAN TWO MONTHS AFTER A major earthquake - followed by a mind-boggling tsunami that incapacitated a nuclear power plant – shook Japan and its financial systems to the core, recovery is seemingly on the horizon, and according to Yoshito Hori, Managing...

Barrick Gold makes winning bid for Equinox

GOLD AND COPPER ARE NOT infrequently entwined in an ore body. So not surprisingly, some gold miners spin off secondary copper production as a by-product.

PE and the pension system

Ontario Teachers’ reported record-high results in 2010, yet substantial liabilities overhang remains, signaling a broad-based issue likely to challenge many pension plans going forward

China's natural resources M&A on the ups

Hot on the heels of AVCJ’s recent China M&A overview, in which higher highs were cited as likely in the country’s ongoing quest to secure future natural resources supplies to keep its development trajectory on track, Minmetals Resources put forward a...

Korean PE goes full circle

While fundraising efforts and investment and private equity activity have been subdued for some time, exit-focused activity is very much on the boil

Apollo takes step forward with IPO, two steps back

On March 22, Apollo Global Management LLC was confident that its imminent IPO prospects were solid. One of its aims was to join fellow private equity giants Blackstone and KKR in going public. In fact, the Apollo event was widely seen as likely to re-ignite...

Ontario Teachers' Pension Plan posts 14.3% rate of return

Canada’s largest single profession pension plan, Ontario Teachers’ Pension Plan (OTPP), announced that it had earned its largest value-add dollar amount ever in 2010, claiming C$13.3 billion ($13.9 billion) in investment income by the year’s end, representing...

PRC drug company Ascletis raises $100 million

Newly launched Chinese pharmaceutical company Ascletis Inc. – which aims to license high-potential drug products from Western companies and develop them into medicines for China’s fast- growing market – has raised $100 million in private funding tranche...

Qihoo shares break out big in NYSE IPO

The share price of Qihoo 360, China’s market-leading provider of internet and mobile security products, and third most popular company in the space by customer volume, more than doubled its already premium-plus $13.50-14.50 per ADS initial offering to...

GIC opens new office in Mumbai

The Government of Singapore Investment Corporation (GIC) announced its intent to open an India office in Mumbai March 31, its eighth overseas.

Apollo Global Management IPO flip-flops

Apollo Global Management LLC (APO) has raised $565 million on its recent IPO, selling 29.76 million shares, or 3.6 million more than it had expected. However, while the shares initially traded at top end of their $17-19 price range, Apollo’s performance...

India's VIA to take flight on $100 million fund raising

Bangalore-based travel services provider VIA moves even faster than its clientele, it would appear. Founded in 2006, the company boasts annual revenues of $500 million, and growth in the 60% p.a. range. And it has just announced it will raise up to $100...

Buy, buy, buy

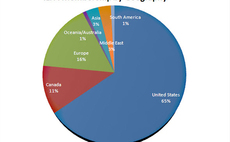

While official data out of the PRC varies, most market observers report increasing M&A activity in all segments of the market. Consensus is this will continue for the foreseeable future, and that private equity will want to be more involved

China's PE boom

With M&A activity in China up an impressive 66% year-on-year in 2010, AVCJ drills down deeper to the drivers behind the deals, who’s buying what, and what it means for private equity

CHAMP Ventures exits TSmarine

CHAMP Ventures last week completed its first foray into the gas and oil sector, finalizing the sale of TSM Group Holdings Pty Ltd. and its subsidiaries (collectively TSmarine) to Fugro Holdings Australia Pty Ltd.

CHAMP Ventures exits TSmarine

CHAMP Ventures, the mid-market PE specialist that is part of Castle Harlan Australian Mezzanine Partners (CHAMP) Group, successfully completed its first foray into the gas and oil sector official on March 3, finalizing the sale of TSM Group Holdings Pty...

Carlyle takes 15% stake in Qube Logistics

Qube Logistics has announced that it has reached an agreement with Carlyle Infrastructure Partners (CIP), a unit of the international private equity giant Carlyle Group, through which the fund will subscribe to up to 91,388,476 shares – or about 15%...

Opportunity knocks, but cautiously so

Twelve months ago, it was all sunshine and roses in Australia. The market has since rationalized and it seems GPs are still remarkably positive, while on the LP side, there are question marks around the market dynamics down under.

Super funds and private equity

Historically, Aussie superannuation funds have been fairly consistent in the way they manage private equity programs, which is also why talk about pulling back from the asset class is making waves.

The heart of the RMB

With so many offshore investors now scrambling to launch RMB funds, the issues around the liberalization of the Chinese currency – which the US government is trying hard, with limited success to effect – longer term convertibility must be addressed.

Miracle or mirage?

International strategic and SWF investment in the country is ramping up, though private equity’s engagement remains tentative. But some early movers say that is changing.

ILPA polishes its private equity principles

New version incorporates more GP and LP input aimed at increasing focus, clarity and practicality on both sides of the private equity equation.

Squalls on the horizon

With the rising rate of Chinese inflation no longer a state secret, the gravity of the problem is clear. But, will the government’s moves be strong enough to curb the problem?