Analysis

(In)famous in Australia: Tax

Foreign investors as LPs and GPs in the Australian private equity industry remain anxious the Australian Tax Office’s recent reversal of years of precedent with two taxation determinations relating to investments in Australian assets by foreign investors....

The heart of the RMB

With so many offshore investors now scrambling to launch RMB funds, the issues around the liberalization of the Chinese currency – which the US government is trying hard, with limited success to effect – longer term convertibility must be addressed.

The bear in China

As the recently released AVCJ 2011 China Report showcases, while private equity was back with a vengeance over the last 12 months – in fundraising, investments and exits – there are larger, macro issues on the horizon that may negatively impact short-term...

Miracle or mirage?

International strategic and SWF investment in the country is ramping up, though private equity’s engagement remains tentative. But some early movers say that is changing.

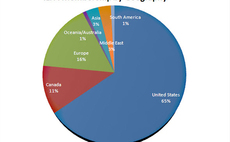

Brazil – battling for emerging Asia dollars?

ASIA HAS ALWAYS SEEN THE LION’S SHARE of emerging markets-dedicated dollars. Latin America has always lagged.

Real assets, real opportunity

THERE HAS BEEN NO SHORTAGE OF REAL estate opportunities in the post-financial crisis world, however deal values in Asia have dropped as a result of many global investors buying lower-priced assets at home. The same is true here in Asia, as well CB Richard...

ILPA polishes its private equity principles

New version incorporates more GP and LP input aimed at increasing focus, clarity and practicality on both sides of the private equity equation.

Squalls on the horizon

With the rising rate of Chinese inflation no longer a state secret, the gravity of the problem is clear. But, will the government’s moves be strong enough to curb the problem?

Silicon Valley is back as China motors on

Two years ago Silicon Valley was preoccupied with the financial crisis. From Q2 2008- 2009, there was one IPO. VCs were looking at projects in the alternative energy, cleantech and life sciences spaces. “Social networking” was a known but unappreciated...

Changing perceptions on Japanese private equity

There is no hiding from the fact that foreign institutional investors have developed a negative view on the current prospects for Japan’s private equity and venture capital industry, which in turn has made a significant impact domestic GPs’ abilities...

State of the Union(s)

Korea and Japan may have fallen off the radar over the past two years, but their governments are working to keep funds flowing in and opportunities front and center for private equity firms

Overseas LPs welcome

Clifford Chance Partners explain what’s in store for foreign LPs looking to convert their currencies into reminbi for private equity investment under Shanghai’s new, liberalized QFLP pilot program

A glimpse into the future

With 2011 upon us, industry players offer thoughts on the major themes for the year ahead, and for the first time in years, the forecast is largely for blue skies and sunshine.

Case In Point: SME Deals On the Rise

As if to prove that 2011 would be the year of the SME investment, Polaris Capital Group has acquired a 100% stake in domestic food chain operator Samukawa Food Planning Co (SFP). Although the deal size was not disclosed by Polaris, Nikkei reports suggest...

Global directives and PE

Private equity investing can be thwarted, stalled or propelled into action in certain countries based on legal and tax structures. AVCJ looks at what may affect the industry in 2011.

New horizons in Southeast Asia

Private equity investment in Indonesia surged in 2010; but the reality of investment opportunity in places like Indonesia and Vietnam requires more than macro growth numbers

Greater China IPOs triple numbers in the US

Exchanges on the mainland and Hong Kong have together raised nearly $120 billion to date in 2010, while the US has raised just $42 billion, a disparity that showcases the shift from slower-growth, developed economies to high-growth, emerging markets....

Headland becomes a test case for post-bank spinout PE funds

One of the most closely watched of the new wave of private equity team spinouts from major banks has completed with the announcement that the management team who led HSBC Private Equity Asia have now completed their separation from parent HSBC with the...

You've been served

Recent developments have highlighted the personal – and legal – issues that can arise when private equity firms and their senior staff part company.

First AVCJ India Awards see Indian industry's coming of age

The first AVCJ India Private Equity & Venture Capital Awards held last week paid tribute not just to individual winners, but also to the overall growth and maturation of the Indian private equity industry.

India and the China Factor

While China and India are very different markets, what they do have in common is their competition for LP investment dollars by funds with a regional mandate.

The great India debate

Private equity investment deals in India may be tricky, expensive and atypical compared to the standard private equity model, but they are potentially lucrative and poised to become even more attractive.

Value add

The fundamentals behind the private equity model imply that, by injecting capital in a company in return for an equity stake, the firm is able to change, alter, tinker and build a stronger, more profitable company.

Jury still out on Shanghai RMB QFLP program

The reported approval by China's State Administration of Foreign Exchange (SAFE) of a $3 billion quota for the Shanghai municipal government to allow foreign currencies to be converted into RMB for investing into local private equity funds has been hailed...