Venture

Angels in Asia: Exporting Silicon Valley

Early-stage investors in the US are casting their eyes eastwards as they seek out new partnerships in Asia. But what can these angels offer the region’s start-up community?

Untapped Japan VC market targets mobile space - AVCJ Japan

Japanese venture capital is still being overlooked by LPs despite the untapped potential of Asia's fastest growing mobile internet space, industry participants told the AVCJ Japan Forum.

CITIC Capital closes VC fund on $113m

CITIC Capital has reached a final close of on $113 million on its debut venture capital fund, short of the $150 million target.

Gray Matters invests in social banker Unitus Capital

Bangalore-based social investment bank Unitus Capital (UC) has received an undisclosed commitment from Gray Matters Capital (GMC)-owned First Light Ventures fund. The vehicle acts as an incubator and investment partner to seed-stage, for-profit social...

Telstra Ventures provides Series D funding for Kony Solutions

Telstra Ventures, the VC arm of Australian telecom operator Telstra, has committed $18.3 million in a Series D round of funding for Kony Solutions, a US-based mobile applications developer. The size of its stake was not disclosed.

Reebonz receives $39m from MediaCorp, VCs

Southeast Asia-focused online retailer Reebonz has received a S$50 million ($39 million) round of funding led by Singapore multimedia group MediaCorp. Existing investors Vertex Ventures, GGV Capital, Intel Capital and Matrix Partners China also participated....

AVCJ China Awards: VC Professional of the Year – Lei Jun

Twenty years ago, Lei Jun joined Chinese software company Kingsoft and dedicated himself to developing its flagship product, WAP Office, a word processing system primed to challenge Microsoft’s mid-1990s offering. It lost.

Yonyou Software sells RayooTech stake to Shenzhen Fortune ahead of IPO

China’s Yonyou Software will sell its entire 18.73% stake in Beijing RayooTech company for RMB75.37 million ($12.26 million) to Shenzhen Fortune Venture Capital. This comes ahead of an expected IPO for RayooTech.

TA invests $25m in India-based data analytics provider

TA Associates has acquired a minority stake in Mumbai-based data analytics provider Fractal Analytics for $25 million. It is the latest in a string of investments in India’s big data space, driven by the synergies between existing business process outsourcing...

Investors commit $100m to another Rocket Internet Asia retail start-up

Southeast Asian online retailer Lazada has raised $100 million through a new round of funding led by Verlinvest, a Beglium-based investment firm set up by the founding families of Anheuser-Busch InBev. Existing investors Holtzbrinck Ventures, Kinnevik...

Tsinghua University investment arm makes buyout offer for Spreadtrum

Spreadtrum Communications, a Chinese mobile chip manufacturer backed by NEA, has received a buyout offer from a unit of Tsinghua Holdings, an investment entity controlled by Beijing-based Tsinghua University. The offer values Spreadtrum at $1.35 billion....

Japanese, Chinese VCs provide $4.4m round for social site Muzy

The Silicon Valley-based venture capital arm of Japanese telecoms giant NTT Docomo, Docomo Capital, and Recruit Strategic Partners - the corporate VC arm of Japanese internet company Recruit Holdings - have teamed up with Chinese entrepreneurs to invest...

Indian pharma firm Cipla launches VC unit

Cipla, an India-based generic drug maker, has set up a VC arm – Cipla Ventures – to invest in biotechnology, medical devices and new chemical entities.

Tencent leads $150m financing round for Fab.com

Chinese internet group Tencent has led a $150m round of investment for US online design store Fab.com, in a fourth round of financing which is yet to close. The deal values the company at $1 billion, not including new capital raised.

Fidelity leads Series B round for India's Cloudbyte

Fidelity Growth Partners India has led a $4 million Series B round of investment in Cloudbyte, a company which provides cloud-storage solutions for online applications. Existing investors Nexus Venture Partners and Kae Capital also participated.

Australia's M.H. Carnegie, Vivant Ventures launch accelerator

M.H. Carnegie & Co, the venture capital firm set up by Australian investor Mark Carnegie, has launched an A$80 million ($76 million) accelerator fund for emerging technology companies. It will be run in collaboration with Vivant Ventures, an Australia-based...

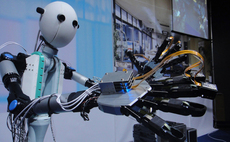

Willing to travel: Japanese tech firms look overseas

Japanese technology companies are going overseas, through corporate venture capital investments, joint ventures or commitments to third-party managers, in search of new markets and innovations

China's Jiuding committed to pre-IPO strategy

China pre-IPO specialist Kunwu Jiuding Capital will not change its strategy despite a slump in listings - and exit multiples - before domestic regulators slammed the door on new share offerings completely towards the end of last year.

IDG invests $4m in China Weipass Series A round

IDG Capital Partners has provided a $4 million round of Series A funding to China WeiPass, a smartphone app for payment verification.

Gree Ventures, MIC back $6m round for Japanese software firm

Gree Ventures and Mobile Internet Capital (MIC) have taken part in a JPY625 million ($6 million) investment round for Accounting SaaS Japan (A-SaaS), a developer of cloud-based accounting software.

Angels say SE Asia ripe for 500 Durians

Dave McClure, Silicon Valley super angel and founding partner of 500 Startups, was on the road in Asia once again this month as part of his firm’s “Geeks on a Plane” (GOAP) tour. While this was not the first time the tech-focused venture capital firm...

Qualcomm leads Series C for Chinese online English education start-up

Qualcomm Ventures has led a Series C round of funding for Shanghai-based online education company Alo7. The capital commitment is believed to be up to $10 million.

Silicon Valley angels end first SE Asia tour in Indonesia

The Geeks on a Plane (GOAP) tour organized by Silicon Valley-based accelerator 500 Startups reaches its final leg in Indonesia this week. This is the first time one of the trips has focused specifically on Southeast Asia.

China's LightInTheBox raises $79m through US IPO

VC-backed Chinese online retailer LightInTheBox saw its stock jump 22% on its first day of trading in New York, following an IPO that raised $79 million. It is the first Chinese company to go public in the US this year, and only the second to make the...