TMT

Fidelity leads Series B round for India's Cloudbyte

Fidelity Growth Partners India has led a $4 million Series B round of investment in Cloudbyte, a company which provides cloud-storage solutions for online applications. Existing investors Nexus Venture Partners and Kae Capital also participated.

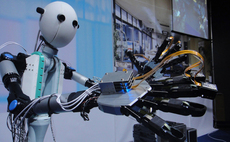

Willing to travel: Japanese tech firms look overseas

Japanese technology companies are going overseas, through corporate venture capital investments, joint ventures or commitments to third-party managers, in search of new markets and innovations

KKR, Blackstone, Carlyle among bidders for SingTel Australia unit - report

KKR, The Blackstone Group and The Carlyle Group are said to have submitted first-round bids for Optus Satellite, the Australian satellite unit of Singapore Telecommunications (SingTel).

PE-owned MediaWorks New Zealand enters receivership

Creditors are poised to take control of Ironbridge Capital-owned MediaWorks as the New Zealand broadcaster and its subsidiaries went into receivership.

IDG invests $4m in China Weipass Series A round

IDG Capital Partners has provided a $4 million round of Series A funding to China WeiPass, a smartphone app for payment verification.

Gree Ventures, MIC back $6m round for Japanese software firm

Gree Ventures and Mobile Internet Capital (MIC) have taken part in a JPY625 million ($6 million) investment round for Accounting SaaS Japan (A-SaaS), a developer of cloud-based accounting software.

Providence Equity loses Asia MD - report

The head of Providence Equity Partners' Hong Kong office, Patrick Corso, has reportedly resigned. It is the fourth senior departure from the firm's Asian operation since it was established in 2007.

China e-commerce logistics: The missing link

China’s fragmented logistics industry is a problem for e-commerce companies as they attempt to provide customers with a better quality service. Should they build competencies in house? Should PE help them?

Qualcomm leads Series C for Chinese online English education start-up

Qualcomm Ventures has led a Series C round of funding for Shanghai-based online education company Alo7. The capital commitment is believed to be up to $10 million.

Silicon Valley angels end first SE Asia tour in Indonesia

The Geeks on a Plane (GOAP) tour organized by Silicon Valley-based accelerator 500 Startups reaches its final leg in Indonesia this week. This is the first time one of the trips has focused specifically on Southeast Asia.

China's LightInTheBox raises $79m through US IPO

VC-backed Chinese online retailer LightInTheBox saw its stock jump 22% on its first day of trading in New York, following an IPO that raised $79 million. It is the first Chinese company to go public in the US this year, and only the second to make the...

Snapdeal partners with eBay, closes $50m funding round

Indian online retailer Snapdeal has raised $50 million from lead investor eBay, Intel Capital, Saama Capital, Russian VC ru-Net and Japan’s Recruit Holdings. Existing investors Bessemer Venture, Nexus Venture Partners and Kalaari Capital also participated...

China Asset Management backs $332m iSoftStone take-private

Chinese IT services provider iSoftStone Holdings has received a take-private proposal from its CEO and chairman, who is working in conjunction with ChinaAMC Capital Management, an alternative investment platform affiliated to fund management company China...

Clearstone-backed Games2Win acquires Indian start-up

Games2Win, an Indian online gaming business backed by Clearstone Ventures, has acquired Backyard Game FactoRy (BGF) - a New Dehli-based game developer.

VC-backed Just Dial share gains 15.5% on first day's trading

Indian business listings and search provider Just Dial saw it shares close at INR612 ($10.79) apiece - 15.5% above the IPO price - on the first day of trading on the National Stock Exchange on Tuesday.

CVC eyes IPO for Indonesian cable operator LinkNet - report

LinkNet, the Indonesian cable television and broadband operator in which CVC Capital Partners holds a 49% stake, is reportedly targeting an IPO this year. It would be the second share offering in 2013 by one of the private equity firm’s Indonesia-based...

Nexus invests $2.5m in Housing.co.in

Nexus Venture Partners will back Indian real estate search portal Housing.co.in with $2.5 million in funding to help expand its technology and data teams.

Shinsei Bank backs Series B for Japan's Smart Education

Shinsei Corporate Investment (SCI), a unit of Japan's Shinsei Bank, has committed JPY75.3 million ($748,000) to educational smartphone app developer Smart Education. This brings the start-up's Series B round to a total of JPY350 million.

KDDI, Yahoo, CyberAgent invest $3m in online language service

KDDI Open Innovation Fund, CyberAgent Ventures and YJ Capital - the investment arm of Yahoo Japan - have taken part in JPY330 million ($3.2 million) round of funding for RareJob, an English-language learning website.

TA-owned SpeedCast acquires Australia's Pactel

TA Associates-backed SpeedCast has acquired Pactel International, an Australia-based satellite communications service provider for an undisclosed sum, as part of effort to strengthen its presence in Asia.

India's Snapdeal acquires e-retailer Shopo

Sequoia Capital-backed Shopo.in, an online marketplace for Indian handicraft products, has been bought by Snapdeal.com promoter Jasper Infotech for an undisclosed amount. Shopo had raised funding from Sequoia, SRI Capital and Seeders Venture Capital in...

HP to divest India's MphasiS, PE firms eye deal – report

The Carlyle Group, The Blackstone Group, Advent International and Bain Capital are said to be in talks to buy HP’s 60.5% stake in Bangalore-based MphasiS, an IT services exporter. Domestic strategic players L&T Infotech and Tech Mahindra have also been...

Inventus leads $2m investment in eDreams Edusoft

Inventus Capital Partners and Mumbai Angels have backed Indian education software company eDreams Edusoft with $2 million in a second round of funding.

SE Asia VC Ardent gets backing from US, Japan partners

Southeast Asia-focused venture capital firm Ardent has received its first round of external funding from US-based Siemer Ventures and Japanese VCs Recruit Strategic Partners and GMO Venture Partners. Details of the transaction were not disclosed.