Sequoia Capital

VC-backed Chinese e-cigarette company targets US IPO

Relx Technology, a Chinese e-cigarette producer backed by Source Code Capital and Sequoia Capital China, has filed for an IPO in the US.

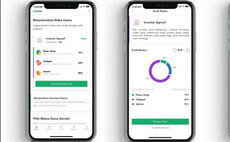

Sequoia India leads $30m round for Indonesia's Bibit

Sequoia Capital India has led a $30 million investment in Bibit, an Indonesian robo-advisory app for first-time investors.

Sequoia joins $81m Series C for India's Cred

Sequoia Capital India has joined an $81 million Series C round for India’s Cred, a credit card rewards start-up also known as Dreamplug Technologies.

Delivery Hero wins approval for Woowa deal in Korea

Private equity investors in Korean food delivery business Woowa Brothers look set for a liquidity event after regulators gave conditional approval for a $4 billion acquisition by Delivery Hero.

China's Zuoyebang gets $1.6b Series E extension

Zuoyebang, which claims to be China’s largest online education company, has secured $1.6 billion in an extended Series E funding round that features Alibaba Group as a new investor.

Sequoia leads $515m Series E for Hong Kong's Lalamove

Lalamove, a Hong Kong-based delivery start-up known as Huolala in mainland China, has completed a $515 million Series E round led by Sequoia Capital China.

PE-backed Pop Mart posts strong gain after $674m HK IPO

Pop Mart International Group, China’s largest fashion toy retailer, gained 79% on its Hong Kong trading debut following a HK$5.22 billion ($674 million) IPO.

LAV, Arch lead $100m round for China's SciNeuro

SciNeuro Pharmaceuticals, a China and US-based drug developer specializing in treatments for central nervous system (CNS) disorders, has announced its formal launch with a $100 million funding round.

China trucking platform Manbang raises $1.7b

Manbang Group, China's so-called "Uber for trucks" that matches shippers with drivers and fleet operators, has raised a $1.7 billion round led by SoftBank Vision Fund, Sequoia Capital China, Permira and Fidelity.

Sequoia leads $46m Series D for Chinese chip maker Yunyinggu

Yunyinggu, a Chinese manufacturer of integrated circuits used in flat screen displays, has raised RMB300 million ($46 million) in Series D funding led by Sequoia Capital China.

Sequoia, Matrix back $200m Series A for China's D3 Bio

D3 Bio, a Chinese drug developer that studies and specifically targets areas where existing approaches to care are not delivering satisfactory outcomes, has raised $200 million in Series A funding.

China short video platform Kuaishou files for Hong Kong IPO

Kuaishou, a Chinese video sharing and social networking platform backed by the likes of Tencent Holdings, Sequoia Capital China, Boyu Capital and DST Global, has filed for a Hong Kong IPO.

Deal focus: V2Food tackles alternative protein's price problem

Australia’s V2Food is bringing affordability to the alternative protein space as fresh funding fuels an Asian expansion. The China entry will be a delicate proposition

Vision Plus, CYTS lead round for China hotel marketing player

Zhiketong – a WeChat-based direct sales and marketing service for high-end hotels – has raised $50 million in its Series D round led by Vision Plus Capital and CYTS Hongqi Fund.

China's JW Therapeutics trades up after $300m Hong Kong IPO

JW Therapeutics, a private equity-backed Chinese drug developer specializing in CAR T-cell therapies that engineer immune cells to fight cancers, has raised HK$2.33 billion ($300 million) through a Hong Kong IPO.

India's Finova gets $55m in equity, debt funding

Finova Capital, an Indian small business lending start-up, has raised $55 million in equity and debt, including $35 million in equity from Sequoia Capital India and Faering Capital.

Southeast Asia start-ups: Trials of leadership

COVID-19 has forced start-ups founders in Southeast Asia – many of whom have never experienced a crisis before – to make tough decisions. For investors, it represents a key test of management credentials

Sequoia joins $22.5m round for Bangladesh's ShopUp

Sequoia Capital India and US-based Flourish Ventures have led a $22.5 million Series A round for Bangladesh B2B platform ShopUp. It is both firms’ first investment in the country.

Australia's V2Food raises $55m Series B

Australian alternative protein producer V2Food has raised a A$77 million ($55 million) Series B round featuring Sequoia Capital China and Temasek Holdings.

3H Health leads $67m Series B for China's EdiGene

China’s 3H Health Investment has led a RMB450 million ($67 million) Series B round for local genetics-based drug discovery and therapeutics developer EdiGene.

China cybersecurity provider BambooCloud raises $44m

Shenzhen-based cybersecurity company BambooCloud has raised a RMB300 million ($44 million) Series C round featuring Sequoia Capital China.

India's Razorpay raises $100m Series D

Indian digital payments start-up Razorpay has achieved unicorn status following a $100 million Series D round led by GIC Private and Sequoia Capital India.

Vision Fund leads $319m round for China's XtalPi

China and US-based artificial intelligence-enabled drug development platform XtalPi has raised $319 million in Series C funding led by SoftBank Vision Fund, the investment arm of insurer PICC Group, and Morningside Venture Capital.

Japan gaming start-up raises Series A, hits $1b valuation

Playco, a Japan-headquartered mobile gaming start-up, has simultaneously formally launched operations and become a unicorn, raising $100 million in Series A funding at a valuation of $1 billion.