Arch Capital

PE-backed Brii Bioscience pursues Hong Kong listing

Brii Biosciences, a three-year-old Chinese biotech start-up that has raised approximately $415 million in private funding from the likes of Sequoia Capital China, Boyu Capital, and Yunfeng Capital, has filed for a Hong Kong IPO.

LAV, Arch lead $100m round for China's SciNeuro

SciNeuro Pharmaceuticals, a China and US-based drug developer specializing in treatments for central nervous system (CNS) disorders, has announced its formal launch with a $100 million funding round.

China's JW Therapeutics trades up after $300m Hong Kong IPO

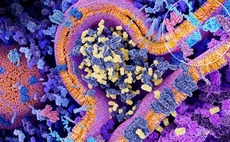

JW Therapeutics, a private equity-backed Chinese drug developer specializing in CAR T-cell therapies that engineer immune cells to fight cancers, has raised HK$2.33 billion ($300 million) through a Hong Kong IPO.

China's Transcenta secures $100m funding round

Transcenta Holding, a Chinese biotech company formed last year through the merger of MabSpace Bioscience and Hangzhou Just Biotherapeutics (HJB), has raised $100 million in an extended Series B funding round.

China's AnchorDx raises $28m Series B

AnchorDx, a China-based company that develops new clinical diagnosis products based on next-generation sequencing (NGS) technology, has raised $28 million in a Series B round led by 6 Dimensions Capital and Sijia Jianxin Fund.

Deal focus: Just delivers on cross-border promise

Lilly Asia Ventures, Arch Ventures and Temasek have backed the expansion of Just Biotherapeutics' China-based manufacturing and research operation

Arch Capital exits India real estate project to Mahindra Lifespaces

Mahindra Lifespaces has bought back Arch Capital's 49% stake in a real-estate joint venture based in the Indian city of Chennai.