Industry

Funds of funds build LP returns

Asia Pacific has always possessed the kind of environment that in theory is well tailored for the fund of funds model.

Indonesia heat

Fresh off the plane back from Jakarta, I can confirm that Indonesia merits the attention private equity GPs and LPs are now paying to it – and that the attention is almost as frothy and buzzing as the overall Indonesian economy.

Navis makes final close on $1.2 billion fund

Navis Capital Partners has announced the official close of its $1.2 billion Navis Asia Fund VI, a vehicle that surpassed Navis’s original $1 billion target fund size and further outpaced its preceding Navis V fund, which raised $1 billion in 2007.

Japan's DBJ and banks to form $1.18bn turnaround fund

The Development Bank of Japan is slated to launch a JPY100 billion ($1.18 billion) fund, specializing in local corporate restructuring and turnaround, in partnership with the Bank of Tokyo Mitsubishi UFJ and Sumitomo Mitsui Banking Corp., at the end of...

Indian pharma firm seeks PE investments

Pharmaceutical firm Zenox Lifesciences Limited looks to raise INR6 crore ($1.3 million) in private equity investments - funding allocated to business expansion measures such as acquisitions.

TPG's Newbridge Asia to sell $1.16 billion of Ping An shares

TPG Capital’s legacy fund Newbridge Asia is reportedly preparing to sell $1.16 billion worth of shares in Ping An Insurance Group Co. of China, coming as the insurer – the world’s second-largest – looks to streamline the integration of its holding Shenzhen...

Fed allows CIC to be second-largest foreign investor in Morgan Stanley

China Investment Corporation (CIC) has reportedly received the green light from the US Federal Reserve to take up to a 10% voting stake in Morgan Stanley, which would make the SWF the second-largest investor in the financial giant after Bank of Tokyo...

DBJ's mezzanine financing supports K Tech's MBO

The Development Bank of Japan (DBJ) has thrown its support behind the management of K Technology Corporation in its endeavor to launch an MBO - a move that would see Japanese PE firm Risa Partners part ways with its asset.

Aavishkaar makes partial exit in microfinance holdings, refocuses on social enterprises

VC firm Aavishkaar Venture Management has partially exited its stake in its microfinance and micro-venture capital funds, coming as the firm looks to refocus its operations on social-enterprise targets in the coming years.

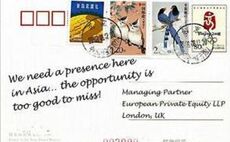

Wish you were here…

European nations may have deep historical ties with the Asia Pacific region, dating as far back as Marco Polo and Vasco da Gama, but European GPs have largely been late entrants to the region. European LPs, especially those with development capital mandates,...

Spring Capital debuts $250 million fund

Hong Kong-headquartered Spring Capital Asia has closed its $250 million maiden fund, a vehicle to be focused on early-growth investments in low- to mid-market companies.

Milestone Capital's JVs invest in CARE

Milestone Capital has invested INR75 crore ($17 million) in Indian credit-rating agency Credit Analysis & Research Ltd (CARE) via two of its joint ventures, the Milestone Religare Investment Advisors and Capstone Investment Advisors.

GOME spat with founder continues

In the latest development in the ongoing feud between Bain Capital investee HKSE-listed GOME Electrical Appliances Holding Ltd. and its disgraced and imprisoned founder Huang Guangyu, Huang has apparently sought to terminate procurement and management...

GBS Venture, CM Capital invest in Pathway Therapeutics

New Zealand pharmaceuticals developer Pathway Therapeutics has sparked a private equity round of Series A Funding following its announcement that it is near to marketing a new breast cancer drug.

Shanghai Minfu forms PRC/Taiwan/Japan billion fund

Shanghai Minfu Equity Investment Management Co., a JV founded by Shanghai International Group Asset Management, a Shanghai city government-related financial institution, Uni-President Group, Taiwan’s largest food manufacturing and logistics company, and...

Reliance Capital appoints Kela as Chief Investment Strategies

Indian financial group Reliance Capital Ltd. has appointed Reliance Mutual Fund’s Head of Equities Madhusudan Kela as its Chief Investment Strategist, charged with expanding the company’s equities and private equity investments business and developing...

China's new investment policy opens PE to insurers

China’s Insurance Regulatory Commission (CIRC) has announced a temporary measure on the use of insurance capital which will allow insurance companies to make direct investment in private companies, as well as private equity funds, for the first time....

CPPIB Intoll deal rolling for $3.01 billion

Canada Pension Plan Investment Board (CPPIB) has received a formal recommendation from the board of Australian toll road player Intoll Group for its A$3.4 billion ($3.01 billion) privatization offer, a 2.5% increase on its original bid price in mid-July....

China's banking regulator looks at banks' PE operations

The China Banking Regulatory Commission (CBRC) reportedly held a meeting with local lenders to gather information on their private equity business, in order to check on internal controls over their activities in the segment.

Taiwan's FSC eases cross-Strait banking, VC rules

Taiwan's regulator, the Financial Supervisory Commission (FSC), has approved new rules for local financial firms to hold controlling stakes in finance leasing or venture capital companies in China.

Frontline Strategy to launch $150 million fund, its third

PE firm Frontline Strategy is to launch its $150 million Clove Route Fund – its third mid-market vehicle – focused on $10-15 million growth capital investments across sectors in India.

Vriti Infocom gets $5 million from JAFCO, Intel

JAFCO Asia has led a $5 million Series B round of funding into Indian e-learning and exam-preparation company Vriti Infocom, with existing investor Intel Capital also participating.

Norwest, Xander Group take stake in Sadbhav Infrastructure

PE players Norwest Venture Partners and The Xander Group have taken a more than 22% stake in road- and highway-development focused Sadbhav Infrastructure Project Ltd., forking over INR200 crore ($42.7 million) apiece for their control.

Back to School

Investment into Asia Pacific's education sector, at a glance, appears to be a promising play. Key emerging markets’ GDPs are on the rise, as are levels of disposable household income and consequently a willingness to invest in education. Many of these...