Industry

Brazil – battling for emerging Asia dollars?

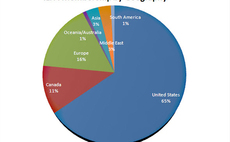

ASIA HAS ALWAYS SEEN THE LION’S SHARE of emerging markets-dedicated dollars. Latin America has always lagged.

Investing without rose-tinted glasses

The CEO of global LP Adams Street Partners, sits down with AVCJ to discuss allocation strategies, the PE industry’s challenges and how his wariness of global mega funds paid off post-crisis.

ILPA polishes its private equity principles

New version incorporates more GP and LP input aimed at increasing focus, clarity and practicality on both sides of the private equity equation.

Accel Partner India launches $400 million fund

Accel Partner, a Silicon Valley’-based venture firm, has set up a $400 million India-dedicated fund, with the aim of targeting opportunities in the domestic growth space, according to local media reports.

Carlyle acquires AlpInvest in first foray into FoF world

After nearly six months of speculation about who would acquire global fund of funds investor AlpInvest – until now held by two Dutch pension funds – the Carlyle Group has been announced as the chosen buyer, marking the PE giant’s first foray into the...

Lone Star may face another tax issue

Lone Star may face yet another tax issue, currently blocking its exit plan for its majority stake in Korea Exchange Bank (KEB).

VIDEO: JP Morgan Asset Management's Lawrence Unrein

Lawrence Unrein, Global Head of JP Morgan Asset Management's Private Equity and Hedge Fund Groups, says that the global private equity industry learned a few lessons about its limits in the aftermath of the global financial crisis, and discusses how the...

Squalls on the horizon

With the rising rate of Chinese inflation no longer a state secret, the gravity of the problem is clear. But, will the government’s moves be strong enough to curb the problem?

More than meets the eye

Early indications suggest that the next 12 months will be a bumper year for the private equity industry. It seems that every fund we talk to has a number of liquidity events in the making, while many notable names are looking to be back in the fundraising...

Changing perceptions on Japanese private equity

There is no hiding from the fact that foreign institutional investors have developed a negative view on the current prospects for Japan’s private equity and venture capital industry, which in turn has made a significant impact domestic GPs’ abilities...

Kaizen gets IFC nod of approval

Indian education-focused private equity group Kaizen Private Equity is awaiting approval from the board for an investment from the International Finance Corporation. The debut fund is targeting $100 million for investments in and around the education...

Alibaba may look to PE for logistics investment

Alibaba Group, China's e-commerce giant, plans to invest $4.5 billion to form a network of warehouses across the nation, possibly through a joint fund set up with a private equity firm.

Swiss-Asia Financial Services to launch energy-focused PE fund – report

Singapore-based asset manager Swiss-Asia Financial Services is said to be raising €500 million ($671.7 million) for a Chinese power plant-focused private equity fund.

Coller Barometer: confidence in PE is at pre-crisis levels

The recent edition of the Global Private Equity Barometer, released by Coller Capital, revealed that LPs’ total exposure to fund-of-funds will fall over the next three years, in part due to fees and in part due to disappointing returns. At the same time,...

State of the Union(s)

Korea and Japan may have fallen off the radar over the past two years, but their governments are working to keep funds flowing in and opportunities front and center for private equity firms

Overseas LPs welcome

Clifford Chance Partners explain what’s in store for foreign LPs looking to convert their currencies into reminbi for private equity investment under Shanghai’s new, liberalized QFLP pilot program

Prudential and Fosun form China PE fund

China's largest privately owned investment conglomerate, the Fosun Group, has teamed up with American insurance behemoth Prudential Financial Inc. (PFI) to launch a $600 million private equity fund of which Fosun will act as general partner. The aim,...

The RMB and Chinese private equity

Chinese leader Hu Jintao will meet with his American counterpart, Barrack Obama this week in the US. While geo-political issues will feature in the summit, economic and trade issue will loom large in the agenda in this meeting, described as the most important...

BNY Mellon creates Sovereign Institutions Group

BNY Mellon, the global asset management and securities servicing company, has formed a new support business, the Sovereign Institutions Group, prompted by the increase in assets under management by sovereign wealth groups globally.

KFH launches Islamic fund

KFH Asset Management, a subsidiary of Kuwait Finance House, an Islamic bank based in Kuala Lumpur, will launch a $300 million fund by the end of 2012, according to Reuters. The fund plans to raise capital from Gulf investors, and will also seek money...

Temasek pays antitrust fine

Indonesia’s antitrust agency (KPPU) has reportedly announced that Temasek Holdings has paid 15 billion rupiah ($1.66 million) through its partially owned affiliate, PT Telkomsel, as its portion of an outstanding fine owed after the group was found in...

Coller Barometer highlights investors' growing skills in Asia

The recent edition of the Global Private Equity Barometer, released by Coller Capital, revealed that LPs’ total exposure to fund of funds will fall over the next three years, partly due to fees and partly due to disappointing returns. At the same time,...

China's Gosen Securities plans to launch the first RMB fund

China's Guosen Securities Co Ltd., Shenzhen-based boutique investment bank, plans to raise a RMB300 million ($45.5 million) private equity fund in Hong Kong following the increase in demand for RMB investment vehicles in China.

China's Fosun Group, Prudential to launch $600 million PE fund

China’s largest privately owned investment conglomerate, the Fosun Group, is to launch a private equity fund with US insurance giant Prudential Financial, with the latter committing $500 million to the vehicle while Fosun injects $100 million.