Funds

RREEF loses Fogle in Asia

Mark Fogle, managing director and chief investment officer for real estate at RREEF Asia Pacific, the alternative investment group of Deutsche Bank AG's asset management division, is leaving the firm after three years of service.

HSBC Infrastructure III first close on $580 million

HSBC has had a first close on its fourth and latest infrastructure vehicle, HSBC Infrastructure Fund III, at $580 million, against a final target of $1 billion.

CNEI closes ahead at $255 million

China-focused growth capital private equity firm China New Enterprise Investment (CNEI) has announced the final close of its second fund,CNEI Fund II, oversubscribed at $255 million, and just above its original $250 million target.

Shanghai to unveil RMP LP plan

A flurry of reports around an ‘official’ Shanghai announcement of a “Trial Plan for the Participation of Foreign Investment in Renminbi Investment Funds” suggested that Shanghai was cementing its status as the destination of choice for foreign GPs and...

Real estate: China boom or bubble?

The role of subprime real estate assets in the collapse of Lehman Brothers in the US and the snowball effect of the GFC may have implicated real estate and all its derivates as largely to blame; but in Asia, and especially China, property seems to have...

Aditya Birla announces Fund I close

Aditya Birla Capital Advisors has announced the close of its first fund, Fund I, at some Rs.800 crore ($176 million).

Shanghai RMB LP plan reported

Reports in PRC media indicate the launch of a “Trial Plan for the Participation of Foreign Investment in Renminbi Investment Funds” to be floated in the Pudong New Area of Shanghai, authorized after an executive meeting of the Shanghai municipal government....

CNEI Fund II closes ahead at $255 million

China-focused growth capital private equity firm China New Enterprise Investment (CNEI) has announced the final close of its second fund, CNEI Fund II, oversubscribed at $255 million, ahead of its original $250 million target.

Ex Taiwanese minister launches PRC RMB fund

Yang Shih-chien, a former deputy economics minister in Taiwan, has reported launched his own RMB-denominated private equity fund.

3i debuts new growth fund

3i Group has launched its new growth capital fund at GBP1.1 billion ($1.6 billion) of assets under management, with $533 million provided by third-party investors - the first time 3i has funded a growth vehicle externally rather than exclusively from...

JAFCO invests Japan headhunter

JAFCO, one of the largest venture capital firms in Japan, invested JPY217 million ($2.4 million) in Biz Reach Inc., a Japanese recruitment site operator, through its JAFCO Super V3 Kyoyu Fund.

Ex-Goldman Hu may skip PE for PBOC

According to Chinese media reports, Dr Fred Hu, the former Managing Director and Chairman of Greater China at Goldman Sachs who recently retired from his post after only two years, may skip his reported plans for an independent private equity fund and...

Saigon AM gets new CIO

Saigon Asset Management, the leading Vietnam investor, has announced the appointment of Michael Kokalari as its new CIO and deputy CEO, to replace Hoang Ngueyn, who becomes Senior Advisor.

Unitius recruits ex-Morgan Stanley, UBS leads

Unitius Capital, a financial advisory business that focuses on capital sourcing for microfinance and other socially-focused operations, has recruited former Morgan Stanley India CEO and Country Head Narayan Ramachandran as its new co-chairman, as well...

Lazard Carnegie Wylie starts Oz pub fund

Lazard Carnegie Wylie Private Equity has announced the formation of an A$100 million ($91 million) fund to buy Australian distressed pubs, hotels and similar hospitality assets.

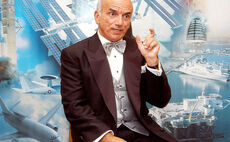

Wilshire woes

Dennis Tito, founder of Wilshire Associates, reportedly paid at least $12 million and possibly up to $20 million for an eight-day stay in orbit at the International Space Station and in transit, courtesy of MirCorp.

New Horizon closes Fund III

New Horizon Investment Advisors, the Beijing-headquartered growth capital GP set up in 2005 as a JV between Temasek Holdings and SBI Holdings, has closed its New Horizon Capital III fund at $750 million, Jianming Zou, a director at New Horizon, confirmed...

CalPERS to commit $1.3 billion to infra

Leading US LP the California Public Employees' Retirement System (CalPERS) is to commit some $900 million to infrastructure GPs and invest $400 million directly, according to an internal statement to its investment committee.

Babson to form mezz team for Asia

Babson Capital Management, the US investment advisor claiming to manage some $100 billion of assets on behalf of global institutions, has announced the formation of a team to invest in mezzanine debt opportunities in Asia Pacific.

UBS mulls RMB fund

Although there has not as yet been formal confirmation, reports suggest that Swiss banking giant UBS is now in talks with the Beijing municipal government regarding setting up a renminbi-denominated private equity fund.

Kleiner, Sherpalo partly exit Info Edge

Kleiner Perkins Caulfield & Byers and Sherpalo Ventures have reportedly sold some 4.08%, almost their complete stake, in Info Edge, the company behind Indian job search website Naukri.com.

UK's PSource plans China infrastructure fund

PSource Capital, a London-based alternative fund management and consulting firm, plans to form a China-focused infrastructure fund with seed capital of several hundred million dollars, committed by an unidentified Chinese investor.

Pru Property appoints new Asia head

Prudential Property Investment Managers, part of the asset-management unit of UK-based insurer Prudential PLC, has appointed Scott Girard, the current CIO of Prudential Investment Management, as its new Asia CEO.

New US rules may affect foreign funds

A new US law, the “Hiring Incentives to Restore Employment Act of 2010,” just signed by US President Barack Obama, could drastically affect non-US financial institutions and private equity funds, as well as US LPs and family offices investing into them,...