China unicorns: Which bubble?

Differentiated business models and strong underlying consumer demand are integral to identifying a start-up that can reach a $1 billion valuation - and retain it once the bubble bursts

Overvalued start-ups in China fall into two categories: soap bubbles and beer bubbles. The former are beautiful, can become large in size if they receive substantial amounts of capital, and leave nothing behind when they finally burst. The latter are like a glass of beer with a large head of foam; when the bubbles clear, the glass is less full, but there is still something to drink.

This was how David Wei, chairman and founding partner at Vision Knight Capital, described the valuation bubble that has dominated China's technology sector for the last couple of years. To put Wei's comments in context, he was participating in a panel at the AVCJ China Forum on the development of the billion-dollar start-up. Plenty of these "unicorns" have emerged on the back of rising incomes, smart phone usage and adoption of e-commerce, but these companies face questions. Are their business models sustainable? Can they continue to raise capital at ever higher valuations?

The panelists discussed how to identify companies with the potential to redefine a segment. While there was general agreement that China will produce more unicorns, the capacity of the internet economy is not unlimited.

Marry the internet with segments such as healthcare or home furnishings and the underlying fundamentals are likely to be strong enough that business models will continue to make sense once the valuation craziness has dissipated. These are beer bubbles. In other areas, remove the subsidies fed to consumers in order to secure market share at whatever cost and there is insufficient long-term demand to justify scale. These are soap bubbles.

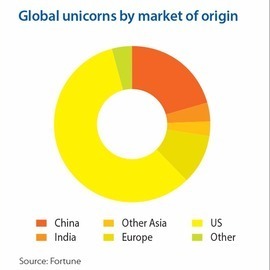

According to Fortune, as of January China was home to 36 of the 174 private internet start-ups globally with valuations in excess of $1 billion. The US, meanwhile, accounted for 101 of the total. Such assessments should be taken with a pinch of salt. Valuations are volatile and it is unclear whether several China entries in the list still warrant the unicorn moniker, even if they did in the first place.

Six Chinese companies appear in the top 20 unicorns, and their prospects vary. It is difficult to see how smart phone brand Xiaomi can continue to raise capital at a $46 billion valuation if handset sales are slowing across the board. Meanwhile, valuations of $10 billion and $8 billion for Lufax and Zhong An Insurance are largely based on what investors think might be achieved in a large market with a number of powerful strategic backers.

However, it would take a huge market shift for these companies to go from unicorn to zero. That is why valuations of the 20 unicorns range from $62 billion to $5.5 billion, while the remaining 154 start-ups span $5 billion to $1 billion. It is unclear whether current valuations are defensible, but the businesses in question are seen as long-term leaders operating in segments that have yet to realize their full potential.

The further you scroll down the list, the more questions arise. Valuation is no definitive indicator of sustainability - the market itself may only be in the early stages of development - but it is not easy for a company operating in a competitive segment to make its mark.

How, for example, will an online peer-to-peer lending platform fare as large internet and financial services companies bulk up their offerings in this area? And what happens to the second or third-largest baby products retailer as its direct competitors continue to expand and other e-commerce players move into the space?

For Chinese start-ups - whether they raise further rounds or get acquired at an attractive valuation - differentiation is the difference between beer bubble and soap bubble.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.