China: Volatile elements

Past experience suggests that volatility can mean opportunity for private equity investors in China

China's GDP grew 6.9% last year, the slowest since 2009 when the country was held back by the global financial crisis. This figure was widely anticipated so it comes as no surprise - nor is it anywhere near the freefall predicted by some naysayers when the Chinese economy started softening.

Public market investors certainly took the news in their stride with the major indices in Hong Kong, Shanghai and Shenzhen all posting gains. This may be more of a sigh of relief than an acceptance of a China with slower growth rates because everyone assures me that the markets will remain volatile for a while.

As for private equity, more than a few investors I've spoken to are quick to dismiss the impact of this volatility on their long-term view on China. However, many are looking at potential investments in industries that the "new China" will be focused on - innovation and services. Venture capitalists will not be the only ones to benefit from this as the availability of larger technology deals such as JD Finance and Lufax - just to pick on internet-enabled financial services - means PE investors can participate as well.

So what does this mean for traditional industries? They may see less capital in the short term as investors and sellers get comfortable with valuations based on the new normal, but don't discount them in the long term. Many of you will have heard this argument before, but a lot of Asia's most significant private equity wins originated in times of volatility. The current environment will certainly create opportunities for investors to acquire assets (perhaps even in the state-owned enterprise space) at reasonable rates. Let's wait and see.

Assets outside of China are also a big focus for private equity firms and local strategic players. Going overseas is a way to counter the local market uncertainty and there are often plenty of synergies afforded by cross-border deals. The acquisition of Legendary Entertainment by Wanda is a prime example, although private equity was on the sell side. Another noteworthy deal is the $1 billion buyout of Germany's KraussMaffei Group, which featured China National Chemical Corporation and AGIC Capital. Will this continue? Most likely.

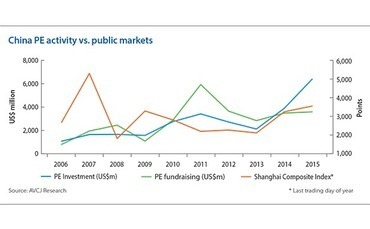

Finally, some interesting perspectives afforded by the graph below. We plotted the Shanghai Composite Index (final trading day figure) against AVCJ Research's fundraising and investment data for China over the last 10 years. It appears that private equity activity is mostly (with some lag) correlated with stock market movements. The only "perfect storm" where all three data sets bottomed out was in 2013, and politics may have been a factor given the new generation of Chinese leadership was preparing to take office.

If the past is any indication of the future, with the investments picking up pace, the future won't be too dark.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.