Asia PE 2015: Guarded optimism

Private equity deal flow this year has been fed by several big auction deals, a healthy dose of co-investment, and ever larger late-stage tech rounds

To most industry participants, 2015 feels like a relatively slow year for private equity in Asia. Perhaps it is the lack of drama-packed hostile takeovers or the comedown from the stellar exits of 2014 such as Alibaba Group IPO or the Oriental Brewery trade sale.

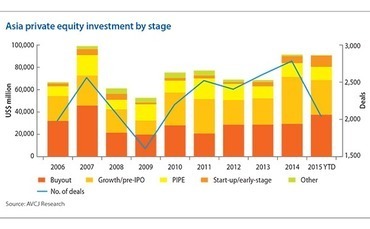

Certainly, the sluggish economies of many Asian countries, volatility in currency and equities markets, and lofty valuations have made many GPs less aggressive this year. According to AVCJ Research, deal volume is tracking down on last year, with just over 2,000 investments announced, compared to nearly 2,800 for 2014 as a whole.

That said, the amount of capital deployed is already on a par with last year (at $92 billion), which means 2015 is all but certain to become the second most active 12-month period on record. The continued rise in total investment value can be attributed to a number of factors, which reflects some of the current trends in the Asian private equity and venture capital space. They include:

- Big auctions are still happening. The $6.4 billion acquisition of Homeplus - Tesco's South Korea operation - by an MBK Partners-led consortium and the $6.3 billion purchase of GE Capital's Australia and New Zealand consumer lending business are the two largest private equity deals ever seen in Asia (and a major reason they the overall investment number is so high)

- Sovereign wealth funds, pension funds and corporations are getting involved in private equity deals. Homeplus is once again a good example, with Canada Pension Plan Investment Board (CPPIB), Temasek Holdings and the Public Sector Pension Investment Board all involved. CPPIB's contribution alone was worth $534 million

- The above comes in many different flavors, with a small but significant number of direct deals as well as co-investments

- The rise of unicorns in Asia. Technology "start-ups" valued at over $1 billion are a pretty common nowadays, with private equity firms, hedge funds and even mutual funds coming into increasingly large funding rounds. Didi Kuaidi, Flipkart and Coupang - representing China, India and South Korea, respectively - are just a few of the names able to attract large amounts of money.

These are but a few reasons why the Asian private equity and venture capital industry is still active and playing a substantial role in the broader M&A market. Based on the amount of dry powder sitting on the sidelines, the potential for even greater involvement is huge.

However, it remains to be seen how quickly private equity investors that have held back choose to reengage. A continued decline in China's economic prospects, which would impact other markets as well, could create investment opportunities. But valuation remains largely a function of competition and the more groups pursuing a deal, the more it becomes a seller's market.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.