Australia: Burgeoning buyouts

Following a bumper 2015 characterized by a few very large transactions, what does this year hold in store for Australia private equity investment?

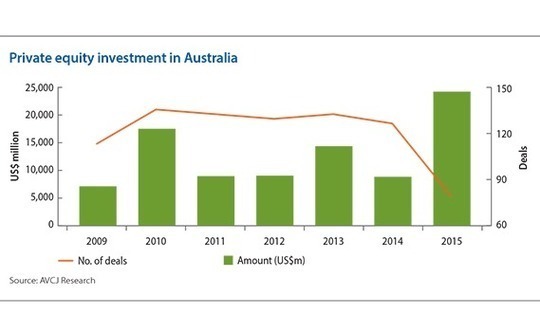

Statistics-wise, 2015 was a big year for private equity in Australia. AVCJ Research has records of 79 investments totaling just over $24 billion, the highest annual total ever seen, and nearly three times the 2014 figure despite a one third drop in transaction numbers. Much like Asia as a whole - $137.8 billion was invested, also a record - the year was characterized by a number of very large deals.

At $6.3 billion, the acquisition of GE Capital's Australia and New Zealand consumer lending business by KKR, Varde Partners and Deutsche Bank led the way. As those familiar with Australian private equity can attest, "normal" deals tend to be much smaller and are perhaps best classified as mid-size, coming in at $50-200 million in enterprise value.

To be fair, the market does see its fair share of abnormal deals but they tend to fall in the infrastructure space. And there was one of these in 2015 as well: A consortium featuring Hastings Fund Management, Caisse de dépôt et placement du Québec (CDPQ) and the Abu Dhabi Investment Authority (ADIA) agreed to pay $7.5 billion for Transgrid, part of the New South Wales government electricity transmission network.

So are the 2015 numbers indicative of what 2016 will bring? In a way yes. First of all, there could be some more bumper infrastructure deals with a slew of ports and pipeline businesses being lined up for privatization, as well as some more electricity assets. By selling off brownfield infrastructure state governments can generate capital to invest in greenfield projects, or so the theory goes.

On a more general level, Australian fund managers are feeling positive, despite uncertainty in the global economy. Local GPs took advantage of the IPO window when it was open, exiting a record number of companies, and now they are looking to deploy more capital. Some already have dry powder at their disposal and several others are preparing to return to market with new funds.

With the spate of IPOs ending early last year, the investment environment has also improved. Company owners that were angling for public offerings - and would only entertain private equity bids at very high valuations - now see their options narrowing. Valuation expectations have also come down.

Meanwhile, the depreciating Australian dollar has restored delineation to the large cap and mid cap spaces. When the currency was strong, pan-regional players with US dollar-denominated funds found their capital didn't go as far and so they started looking for middle-market deals and coming up against local GPs. This trend now appears to have abated.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.