Investor relations: Talk isn't cheap

The enforced adoption of virtual communications points to longer-term changes in investor relations, from annual general meetings to informal catch-ups. GPs must find ways to stand out

Quadrant Private Equity doesn’t do annual general meetings. The Australia-based GP started out giving LPs one-on-one briefings and it has never stopped, largely because performance is strong, the funds are oversubscribed, and LPs are reluctant to push the issue. However, some do privately question whether this approach can work forever.

Like many of its peers, Quadrant maintains a regular dialogue with LPs – formal and informal – supplemented with detailed quarterly reporting. Team members are available for follow-up calls. Moreover, during COVID-19, the firm has been complemented by investors on the quality, granularity and timeliness of its communications.

One wonders whether conciseness is another characteristic of Quadrant’s offering. By most accounts, GPs compensated for the uncertainty created by COVID-19 earlier in the year with ever more frequent and comprehensive missives. These were generally welcomed by LPs, but several told AVCJ they sometimes felt overwhelmed by information.

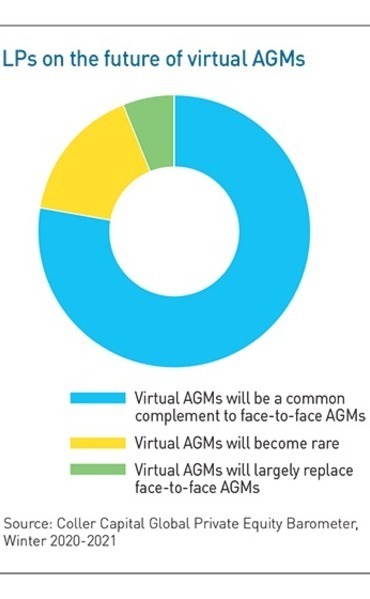

The survey also quizzed investors on virtual AGMs, which have fast become a fixture of the private equity landscape. More than three-quarters expect this format to remain, albeit in tandem with the traditional face-to-face arrangement. This offers some statistical context to trends that have to date largely been captured through anecdotal evidence.

LPs generally like virtual AGMs because they are shorter, it’s possible to attend three in a day, junior staffers can participate alongside the director who would normally fly to the in-person meeting alone, and content is generally available in the cloud for retrospective review. That said, most can’t wait to jump on a plane again, recognizing that less direct interaction means less accountability.

Nevertheless, the rise of hybrid AGMs has broad implications. Managers must do more to hone virtual delivery, which will likely involve greater investment in technology, without neglecting the needs of those attending in person. It might be as simple as filming what takes place on stage in the standard hotel function room, or it might not. Some global GPs are already placing greater emphasis on production values and diversified delivery.

Similarly, investor relations in general is likely to evolve in tandem with the availability and acceptance of virtual options. Some LPs – though certainly not all – suggest that they may attend AGMs less frequently in person if the content is also available online. This means communication outside of the meeting becomes more important, but it goes beyond that. While GP-LP engagement has risen during COVID-19 in the interests of transparency amid chaos, it is unlikely to return to previous levels post-pandemic.

The onus is on managers to find ways to make their offerings relevant and refreshing, perhaps across different media. To some extent, the challenge facing the industry is how does it institutionalize – or replicate on a larger scale – the kind of interaction that the likes of Quadrant have cultivated with investors organically and over a longer period.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.