India fundraising: Speed matters

Kedaara Capital's fundraise is expected to move quickly by Indian private equity standards, but the GP will need to answer the same questions as its peers on timing and re-ups

The official launch of Kedaara Capital's third fund is yet to come, but last week the Indian private equity firm held talks with LPs about its plans. One thing everyone wanted to know was where Kedaara would set its hard cap. The answer, according to sources familiar with the situation, was below $1 billion.

The $1 billion threshold is significant in India's middle market. Only a few independent GPs have crossed it and the outcome wasn't necessarily favorable. ChrysCapital Partners scaled back its 2007-vintage fund to $960 million because there weren't enough big-ticket opportunities. New Silk Route hasn't returned to market since raising $1.38 billion in 2008. True North set a hard cap of $1.1 billion for its sixth fund in 2017 but revised the target to $800 million and ended up with $600 million.

Kedaara would likely have little trouble topping $1 billion. The firm, established by Manish Kejriwal, formerly India head at Temasek Holdings, and General Atlantic alumni Sunish Sharma and Nishant Sharma, closed its debut vehicle at $540 million in 2013 despite a difficult fundraising environment. Fund II hit its institutional hard cap of $750 million – the total is $795 million, including the GP contribution – within three months in 2017. Most investors saw their allocations cut back.

Kedaara launched Fund II having secured an earlier-than-expected exit from Bill Forge with a 50% IRR. Fund I is now said to be tracking at more than 3x net, with full or partial exits from the likes of Manjushree Technopack, Mahindra Logistics, Au Small Finance Bank, Aavas Financiers, and Spandana Sphoorty Financial.

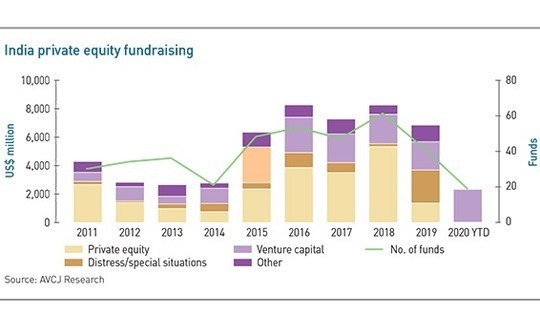

With COVID-19 limiting due diligence opportunities, fundraising is understandably sluggish. India-focused managers have raised $2.3 billion so far this year, compared to $6.8 billion for the full 12 months of 2019. Almost all the capital has gone to VCs, with Sequoia Capital India alone collecting $1.35 billion for its latest India and Southeast Asia collection of vehicles. Even in a good year, the market is relatively shallow, with only a handful of local GPs capable of raising $500 million-plus.

Kedaara is in an advantageous position thanks to its track record and institutional following. However, the key question it must answer internally is much the same as that confronting all GPs, whether it's Samara Capital taking the temperature of the market, Gaja Capital doing a soft launch, or – to some extent – Multiples Alternative Asset Management moving from first to final close. How loyal are your existing LPs?

Where there is that groundswell of existing support, GPs should not hold back because as soon as the situation normalizes, a fundraising glut will follow. A swift first close – or even a final close – comprising re-ups alone might be a desirable outcome.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.