China IPOs: Onshore attraction

The valuations available on China's booming Star Market are prompting US dollar managers to consider restructuring companies for onshore listings. How long will the fervor last?

What possesses a Chinese company – and its investors, if they get a say – to go to the trouble of dismantling an offshore structure with a view to pursuing an onshore IPO? Money, obviously. And right now, the Star Market is the place to get it.

AVCJ Research has records of more than 60 listings by PE and VC-backed companies on the Science & Technology Innovation Board since it launched towards the end of last year (there have been over 100 in total). Together they have raised more than $11 billion. In 2020 to date, Chinese companies with financial sponsors have generated $16.9 billion from just over 100 offerings. The Star Market is responsible for nearly half, by number of IPOs and by capital raised.

Unpicking the motivation behind this fervor, one runs into what appear to be structural and cyclical considerations, although whether these confirm to long-term and short-term norms, respectively, is anyone's guess. First, the US has lost some of its appeal as a listing destination. Not only are Chinese companies subject to more scrutiny thanks to Luckin Coffee, but there are real fears that legislators might deny them access to the New York markets as a byproduct of China-US tensions.

Second, the valuations available on the Star Market are verging on the ridiculous. Massive first-day trading gains – unlike other Chinese bourses, there is no cap – have become routine and the average price-to-earnings (P/E) ratio was 85. This compares to below 15 for the Shanghai A-share market.

For now, at least, the reasons appear compelling enough to have US dollar-denominated fund managers are on the phone to lawyers about the implications of removing a variable interest entity (VIE) – the structure that allows foreign participation in restricted industries; it is barred for domestic listings, unless the company wants to issue Chinese Depository Receipts. Investors must also be prepared for long lock-up periods, restrictions on share sales, and possible exchange rate losses.

If all this sounds familiar, it should. In late 2014 and early 2015, onshore restructuring was in vogue as companies sought to make hay while the sun shined on the Shanghai and Shenzhen A-share markets, Chinext and the Shenzhen SME Board. Even the National Equities Exchange and Quotation (NEEQ) – or the New Third Board – was regarded as a viable option for start-ups in need of liquidity.

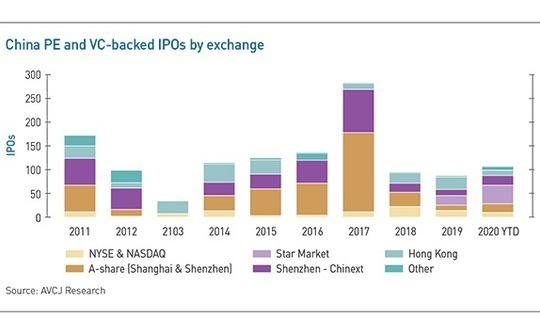

Once the sun stopped shining, the moment passed. The Shanghai Composite Index topped 5,000 points in June 2015, its highest level since before the global financial crisis. Three months later, amid widespread macroeconomic concerns and then an embargo on new listings, it had slumped to around 3,000 points. The markets got their mojo back in 2017 as a record 256 PE-backed companies listed, but it proved a temporary spike as scrutiny of listing candidates intensified.

Spurred by Star Market activity and a robust public markets recovery in the past two months, the IPO tally for 2020 already exceeds the 12-month totals for 2018 and 2019. Policymakers clearly want the Star Market to be a home for Chinese tech start-ups that previously were more comfortable offshore – and the flexibility of the rules reflects this – but can the uptrend be sustained?

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.