China healthcare IPOs: Good prognosis?

There has been a steady stream of China healthcare IPOs - most of them drug developers - on the domestic, Hong Kong and US bourses in recent months. They might be benefiting from a COVID-19 tailwind but it won't be permanent

Two months ago, Akeso Biopharma became the eighth Chinese private equity-backed healthcare company to go public since the start of the year. At a time when the general IPO market was exhibiting volatile tendencies, healthcare seemed to be a beacon of stability.

"Given the coronavirus outbreak, the fundamentals of a lot of companies are shaky, but these companies are benefiting from the situation," Andy Lin, founding partner of Loyal Valley Capital, an investor in Akeso, told AVCJ at the time. "The pandemic exposed the weakness of public healthcare systems globally – there is a huge need for an overhaul. Investment in public health systems, hospitals, vaccines, innovation, and healthcare companies will improve in the years to come."

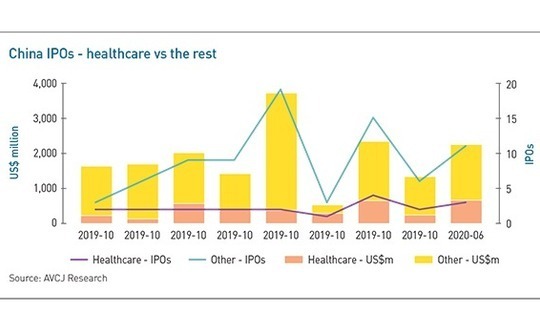

The number of China healthcare IPOs for the year now stands at more than a dozen with an aggregate $2.6 billion raised, according to AVCJ Research. They account for about 30% of the proceeds from all private equity-backed offerings, up from 23% for 2019 in full.

SinocellTech – which two biosimilar treatments ready for a market and a long pipeline of innovative drugs in development – raised $181 million on the Star Market and last week saw its valuation rocket to RMB37 billion ($5 billion) once trading began. Meanwhile, two Chinese genetic testing businesses, Burning Rock and Genetron Holdings, listed within a week of each other on NASDAQ, receiving a warm response.

There appears to be little other explanation than Lin's long-term bullish stance on healthcare. Few, if any, of the listing companies are direct beneficiaries of COVID-19.

MGI Tech, a manufacturer of gene sequencing devices, raised a $1 billion round thanks in part to regulators greenlighting its latest sequencer. It was one of four coronavirus detection products granted emergency approval. In contrast, Burning Rock and Genetron – which specialize in tests that help diagnose cancer – have seen a reduction in business as hospitals prioritized COVID-19. Similarly, many drug developers have been forced to suspend or slow down clinical trials.

Allowing listings by pre-revenue biotech companies is still a relatively recent innovation in Hong Kong and on the Star Market. From the outset, regulators in Hong Kong were concerned about retail investors with little relevant expertise having exposure to unproven businesses. In April, new rules were introduced requiring prospectuses to be written in a way that makes them understandable to laymen, while product development timelines must be realistic and risk factors properly explained.

This might be general housekeeping, but it underlines the fact that not all drug developers are made equal. Lin's investment qualification criteria include a strong management team, a portfolio of drugs (as opposed to just one or two) progressing through clinical trials, and the ability to demonstrate true innovation in products. While Chinese healthcare is likely to receive a wave of policy-driven funding in coming years – partly due to COVID-19 – a rising tide doesn't necessarily lift all boats.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.