Chinese IPOs: One less option

Will Chinese companies listed in the US become the latest casualties of tensions between the two countries? It could lead to a narrowing in IPO exit options for PE and VC investors

Only a dozen Chinese buyouts have surpassed $1 billion in value, according to AVCJ Research. Half of them were PE-backed privatizations of US-listed companies. Another of deal should soon join this list, with online classifieds platform 58.com agreeing a $8.7 billion acquisition by Warburg Pincus, General Atlantic and Ocean Link. The three GPs are working in conjunction with the founder and chairman of 58.com, as if often the case in these situations.

Such take-private stories are nothing new. Transactions have come in waves at several points over the past decade, typically driven by a collection of factors: frustration at the cost of maintaining listing status; increased scrutiny of all Chinese companies on the New York Stock Exchange and NASDAQ as a result fraud scandals; and the prospect of a higher valuation in Hong Kong, Shanghai or Shenzhen.

Add to these the possibility that Chinese companies will no longer be welcome on US exchanges. 58.com is not necessarily part of this trend, but NetEase and JD.com certainly are. The two technology giants have both completed Hong Kong share offerings in the past fortnight. Plenty more US-listed Chinese businesses are expected to raise money in Hong Kong due to a tougher regulatory environment. NetEase has suggested it might de-list from NASDAQ.

The problem is one of longstanding, but it has gained political currency amidst ongoing tensions between China and the US. Beijing refuses to allow the US Public Company Accounting Oversight Board (PCAOB) to inspect audits of Chinese companies listed in the US. It means Chinese stocks come with a perennial health warning and the lack of transparency has contributed to numerous blow-ups. The fraud scandal currently engulfing Luckin Coffee could not have come at a worse time.

President Donald Trump has indicated he would like Chinese companies to follow US accounting standards, while Senator Marco Rubio is pushing ahead with legislation that would force these businesses to vacate US exchanges unless they permit PCAOB inspections. The concerns of US regulators are valid, but these developments should also be regarded in the context of decoupling. Twelve months ago, the escalation of stand-offs in trade and technology to include finance was discussed as a theoretical possibility. Now the odds are narrowing on it becoming a reality.

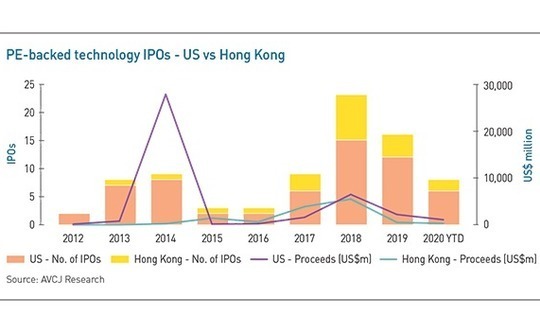

There might be opportunities for private equity if companies choose to de-list without first doing a share offering elsewhere. More significantly, if the US becomes too much of a risk, investors will have to re-think their exit strategies. Hong Kong should be a major beneficiary, but the bourse is still a relative newcomer in terms of technology IPOs and it may not be the most suitable location for some companies. The US, by contrast, is a tried and tested source of liquidity. As in numerous other contexts, if decoupling translates into a reduction in options, it is not welcome.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.