Uncertain times: The outlook for Asia

Private equity activity is lagging in Asia across fundraising, investment and exits as a result of political and economic headwinds. But there is still appetite for new managers and strategies

Uncertainty and volatility have plagued Asian private equity in 2019. From US-China trade tensions and Brexit to a rationalization of unicorn valuations and a revising of growth prospects, a host of political and economic forces have conspired to dampen market sentiment. With two months to go, Asia private equity fundraising is down 41% on the full-year total for 2018, investment is down 36%, and exits are down 62% according to AVCJ Research.

Nevertheless, there are some bright spots. There is clearly still appetite among LPs for spinouts by teams with a certain pedigree. This was most visible in China as DCP Capital raised $2 billion for its debut fund – including $500 million for a renminbi-denominated sidecar – and Centurium Capital secured $2 billion for its first vehicle. The former was started by David Liu and Julian Wolhardt, previously senior executives at KKR, and the latter by David Li, ex-China head at Warburg Pincus.

In the venture capital space, J.P. Gan was able to leverage his decade-long track record at Qiming Venture Partners to raise $352 million under the Ince Capital Partners banner, while the ex-Sequoia Capital team at A91 Partners raised a similar amount for early-stage deals in India. Several other groups that have spun out within the last four years showed they still have momentum by raising second US dollar funds. They include Genesis Capital, Xiang He Capital, XVC, Sky9 Capital and Insignia Venture Partners. Indeed, Joy Capital is already on to Fund III.

The headline fundraising number is likely to be buoyed in 2020 as several larger pan-regional GPs return to market. The big question on everyone's lips is how much KKR will raise for Asia Fund IV.

As for investment, the prospects vary considerably by geography and strategy. Anyone looking to do a large-cap buyout in Australia, Japan or Korea must still pay top dollar, but there are pockets of value elsewhere in Asia. For example, GPs claim to be seeing considerable deal flow in China as mature businesses look for strategic assistance and start-ups revise their expectations as to how much VCs will pay. It all comes down to getting comfortable with the valuation, which is never easy in uncertain times. That same uncertainty is plaguing exits, but the recent IPO revival is encouraging – for some, at least.

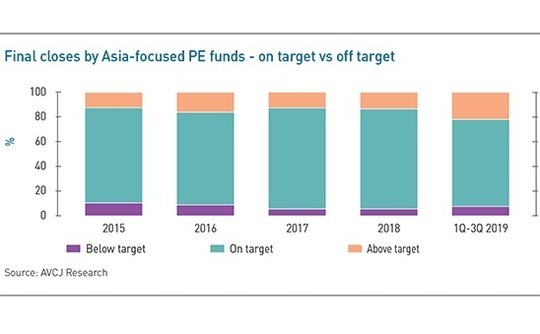

Finally, it is worth noting that bifurcation remains the most overused word in Asian private equity. The notion of a flight to quality, as capital gravitates towards managers who are perceived as the elite, has been a prevalent trend ever since the global financial crisis. In a soft market, one might argue that its impact is accentuated – and the graph below appears to say as much. Of the final closes in the region so far this year, 22% have come in above target, the highest percentage since we started tracking the statistic in 2015.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.