Testing China: Openings in a downturn?

With the health of China's economy deteriorating, private equity investors have every reason to expect to see plenty of opportunities to deploy capital in 2019

AVCJ Research has records of approximately 300 private equity buyouts since 2010 involving China-based assets or activity by Chinese acquirers in international markets. Only a handful of these have been carve-outs from Chinese companies by independent GPs. If anything, the past decade has been characterized by corporate consolidation at home and expansion overseas.

CITIC Capital and FountainVest Partners recently added to this modest number with the acquisition of a majority stake in China Merchants Loscam, a pallet and packaging business. The owner was Sinotrans, a listed subsidiary of China Merchants Group that wants to concentrate on its core logistics services offering. How challenging have conditions in China become if local conglomerates are offloading assets?

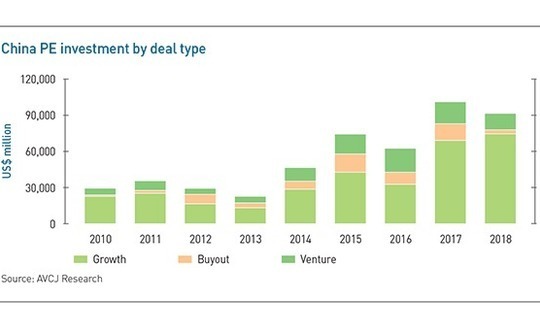

There were 18 buyouts of China-based businesses in 2018 worth a combined $3.3 billion, down from $13.7 billion across 27 deals the previous year. A relative paucity of large-cap transactions is primarily responsible for the decrease. However, there is every reason to believe that 2019 could be more active.

By most accounts, investor sentiment in China is incredibly weak, as demonstrated by the steady decline in the Shanghai Composite Index since January of last year. Trade tensions with the US are a factor – and tariffs should start to weigh on export statistics once the front-loading of shipments wears off – but the domestic economy has been slowing for a while. GDP expanded by 6.5% in the third quarter, the slowest pace of growth since the global financial crisis. Other key economic indicators have painted a similarly dim picture.

More recently, Apple issued a revenue warning, citing declining sales in China, while an economics professor at Renmin University sparked concern by suggesting that GDP growth could be as low as 1.67% in 2018. Censors swiftly removed references to his presentation from local websites.

Previously, Beijing has responded to economic downturns by boosting fixed-asset investment, offering incentives to exporters, and loosening credit controls. But any of these tools could undermine deleveraging efforts intended to reduce the debt-to-GDP ratio. ANZ Bank observed in a December research note that fixed-asset investment contributed 33% of GDP growth in the third quarter compared to 67% in 2010, while expansion in the M1 money supply – which represents corporate cash deposits – hit a historic low of 2.7% year-on-year in October.

For private equity investors with capital to deploy, conditions might be favorable. They have the capacity to ride out difficulties by holding positions for the long term and some have the capabilities to drive operational transformation.

CITIC Capital has announced or completed six corporate carve-outs in the last two years, most of them from multinationals looking to exit a Chinese market that has gradually become more challenging. There are likely to be more deals of this nature, and it might not be only the foreign corporates that are selling.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.