Australia take-privates: Super show

AustralianSuper is supporting BGH Capital - a portfolio GP - on privatization bids for two companies in which the superannuation fund is an investor. Is this a new model for GP-LP partnerships in Australia?

Most domestic LPs were said to have missed out on allocations when BGH Capital raised A$2.6 billion ($2 billion) for its debut Australia and New Zealand-focused fund. The firm – which was founded by Ben Gray, formerly co-head of Asia at TPG Capital – secured commitments from the likes of GIC Private, Ontario Teachers' Pension Plan (OTPP), and Canada Pension Plan Investment Board (CPPIB). The only substantial local participant was AustralianSuper. But what a participant it is turning out to be.

This week, a BGH-led consortium resumed its pursuit of listed hospital operator Healthscope, having seen a A$4.1 billion bid rejected in May. The offer on the table is unchanged – A$2.36 per share – but BGH is cranking up pressure on the board through the shareholder roster. The consortium has increased its interest in Healthscope from 14.5% to 18.3%, comprising 15.6% in voting power and 2.71% under an equity swap. It also claims to have won the backing of Ellerston Capital, which owns a further 9.9%.

While GIC, OTPP and CPPIB are all part of the consortium – the privatization would require a substantial amount of co-investment – AustralianSuper is the key player. The superannuation fund has the bulk of the 15.6% voting power. It also owns 5.4% of Navitas, a listed education services provider that received a A$1.97 billion buyout offer from BGH three weeks ago.

Previously regarded in most cases as a supportive shareholder that would hold its public market positions for the long haul, AustralianSuper has now become a potential thorn in the side of management teams. The implications for large-cap private equity deal flow in Australia, and the role domestic LPs could play in facilitating transactions, is unclear.

The Australian Financial Review published a table of 26 companies in which AustralianSuper holds an interest of 5% or more, ranging from A$9.3 billion gaming behemoth Tabcorp Holdings to A$52 million veterinary services company Apiam Animal Health. It looks like a hit list, but not every business is a feasible target for BGH, based on size and performance. Even those that do meet baseline criteria would have to compete for attention with investment opportunities BGH sources through other channels.

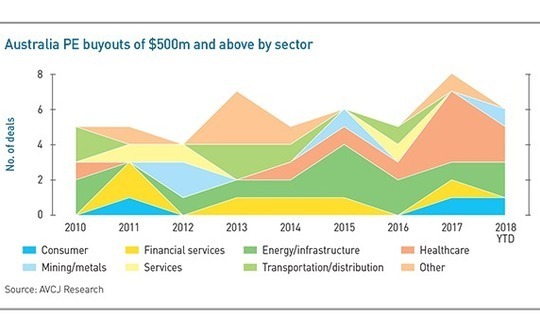

Should other local LPs follow AustralianSuper's lead and support attempts by portfolio GPs to acquire listed companies, it's possible that take-privates might become easier. AVCJ Research has records of 50 Australian buyouts worth $500 million or more since the start of 2010. Infrastructure and energy deals account for about 20, while there have been only four corporate take-privates. Numerous other attempts have failed to win favor from boards that can be hostile to private equity.

That said, AustralianSuper is an outlier in its home market. The superannuation fund has A$145 billion in assets, about 40% more than its nearest peer and about twice as much as the second-largest industry fund. It needs to put capital to work, it is large enough not to mind treading on some toes, and it appears to have faith in BGH's ability to execute – to the point of forgoing potentially more lucrative take-private offers.

It remains to be seen whether this relationship represents a marriage of convenience for a couple of deals, an interesting twist on the GP-LP relationship in Australia, or indeed evidence that superannuation funds are finding new ways to leverage their size and influence in the pursuit of returns.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.