Chinese corporate-PE partnerships: Meeting of minds

Collaborative deals between private equity firms and Chinese strategic players reflects the more diverse range of corporates seeking outbound deals - and also a recognition among GPs that they need help growing newly-acquired assets in China

A parallel can be drawn between the increase in joint acquisitions between private equity firms and Chinese corporates on outbound deals and the nature of the corporates seeking investments.

Such partnerships didn't really exist until a few years ago because state-owned enterprises (SOEs) were the dominant force in cross-border transactions. When Sany Heavy Industry bought Germany-based Putzmeister in 2012 and CITIC Private Equity chipped in for 10%, the deal was something of a novelty. It was said at the time that the GP got involved to help with negotiation and structuring – and it duly exited six months later when Sany acquired the stake.

SOE-PE collaborations remain an anomaly, such as AGIC Capital's participation in the China National Chemical Corp-led acquisition of KraussMaffei in 2016. In general, the two sides just don't click because a SOE struggles to comprehend a commercially-oriented GP's need for exit guarantees and minimum returns.

The rise of the private enterprise in outbound deals can be seen in some of the transactions agreed the same year that AGIC took a stake in KraussMaffei. PAG Asia Capital teamed up with Legend Capital and Apex Technology to buy US-based Lexmark International; Primavera Capital Group and Shanghai Pharmaceuticals acquired New Zealand's Vitaco Holdings; and an assortment of GPs backed Tencent Holdings and Qihoo 360 Technology as they pursued software deals in Finland and Norway, respectively.

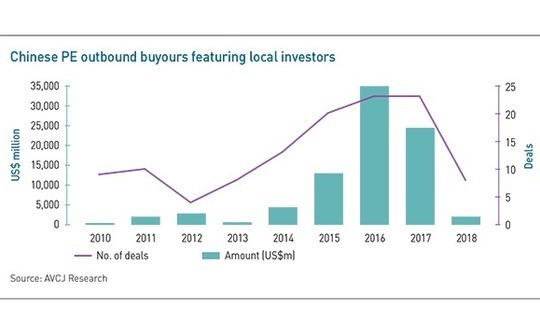

In 2013, Chinese investors announced eight outbound buyouts. This rose to 20 in 2015 and then 23 in each of the next two years. These totals include solo acquisitions by Chinese private equity firms, but in recent years partnerships appear to have become more prevalent – largely because GPs increasingly recognize that they need local support when trying to grow these newly-acquired businesses in China.

Three of CITIC Capital's last four outbound deals have featured Chinese strategic players. When bidding for Ansell's sexual health business and Euromoney Institutional Investor's financial information database division, the GP brought in relevant Chinese players. CDH Investments pursued Australian medical device manufacturer Sirtex Medical with a similar rationale. China Grand Pharmaceutical & Healthcare Holdings was introduced as the PE firm's co-investor and the prospect of a direct distribution line into China helped convince the board to pull the plug on a deal with a US strategic.

It is doubtful whether any of these Chinese partners could have sourced and closed these transactions on their own. In this sense, it is fair to say that a more diversified set of buyers are now targeting outbound investments and private equity can play a meaningful role in helping less experienced corporates get deals over the line. But these situations are also increasingly a meeting of minds – and in the conception and execution at least, the alignment missing from SOE-PE collaborations is very much evident.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.