Japan VC: Acorns to oaks

Japan Post Investment Corporation seeks to fill the late-stage investment gap in Japan's venture capital market that local VC investors lack the capacity to address

Mercari has taken two years to transition from Japan's first unicorn into one of its biggest-ever VC paydays. Global Brain, East Ventures, Itochu Technology Ventures, GMO Venture Partners, World Innovation Lab (WiL), and Globis took around JPY33.7 billion ($307 million) off the table as the consumer-to-consumer marketplace raised JPY110 billion in its IPO.

These investors dominated Mercari's initial funding rounds, including a JPY2.36 billion Series C in late 2014. But none of them had the capacity to lead the JPY8.4 billion Series D, which took the company's valuation past the $1 billion mark. That honor went to a strategic investor – Mitsui & Co – as tends to be the case with later-stage rounds in Japan.

Much is made of Japan Post Investment Corporation's (JPIC) emergence as co-investor in private equity buyouts. The unit, established earlier this year by Japan Post Bank and Japan Post Insurance to target direct deals, has raised $900 million for its first fund, which is expected to close by March of next year at $1.2 billion. Of this, 60% will go towards co-investments alongside GPs, initially in the domestic market.

However, in terms of making a long-term contribution to the Japanese economy, JPIC's smaller venture capital allocation – 30% of the Fund I corpus – could end up being more significant. Speaking at the AVCJ Japan Forum, JPIC CEO Tokihiko Shimizu highlighted what he sees as the gaping late-stage hole in the country's VC space. While the incumbents could shepherd a company to a small IPO of around JPY10 billion, there are not very many investors capable of being the bridge to an offering of JPY50 billion or more.

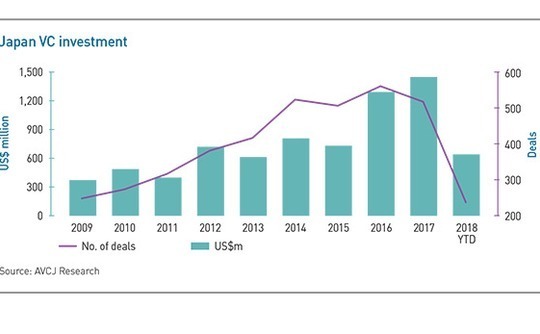

Venture capital investment in Japan is on an upward trajectory, reaching a record $1.3 billion last year, although that was spread across approximately 550 transactions. AVCJ Research has records of only about 20 deals of $40 million or more. Mercari's Series D was until recently the largest ever seen, excluding investments in which Innovation Network Corporation of Japan (INCJ) – with its remit that stretches beyond venture capital – was the sole participant.

In the past nine months, lunar exploration company iSpace has raised a $90.2 million round, said to be Japan's largest Series A to date, while e-commerce platform Inagora and stock trading app Folio received $68 million and $63 million, respectively. Strategic investors were the prime movers in the iSpace and Inagora rounds; there were VCs behind Folio but they participated alongside Goldman Sachs.

JPIC can invest up to JPY3 billion per round in these deals, positioning itself as an ideal participant in rounds in the $30 million and above range. If where JPIC goes others follow, the influx of capital would broaden the venture capital ecosystem, offering more options to companies that are seeking scale but don't necessarily have the means to achieve it.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.