China VC: Selection issues

China's venture capital space is increasingly popular among LPs, overpopulated by GPs, and generally difficult to navigate

Expect 2018 to be a big year for China VC fundraising. With five months gone, the total raised stands at $7.3 billion, split 60-40 in favor of renminbi-denominated vehicles. This compares to $9.7 billion and $10.7 billion for the full 12 months of 2017 and 2015, respectively; and if the bumper China State-owned Venture Capital Fund is excluded from the 2016 total, that comes to a more comparable $12.2 billion.

Final closes so far this year include only one reasonably large government guidance fund with a corpus of $1.5 billion. The rest can be categorized in several ways: established names (Qiming Venture Partners, Sinovation Ventures); spin-outs from foreign GPs (Ron Cao and Chuan Thor, formerly of Lightspeed Partners and Highland Capital Partners, respectively, have raised money as Sky9 Capital and AlphaX Partners); and rising local stars (Vision Plus Capital Partners, which was established by one of the co-founders of Alibaba Group, has closed Fund II).

With the likes of GGV Capital, DCM Ventures, Genesis Capital, SBCVC, and Sequoia Capital all in the market or preparing to enter it, the chances of eclipsing 2016 are high. Sequoia alone is seeking up to $2.5 billion for China seed, venture and growth funds – and demand is traditionally strong enough that the GP allocates quotas to investors rather than make pitches for capital.

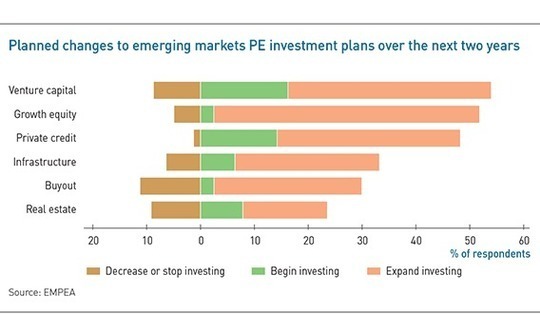

EMPEA's latest global LP survey found there is no shortage of institutional players looking to boost their emerging markets VC exposure. Over half of respondents plan to begin or expand investment via venture capital funds over the next two years, more than any other strategy included in the survey. The last time this question was posed to LPs, in 2016, only 29% were similarly bullish on VC.

China is not the only emerging market of interest. With Sequoia targeting up to $675 million for India and Nexus Venture Partners expected to close on around $450 million, VC fundraising in the country should top last year's $1.9 billion if not the record $2.6 billion set in 2016. Similarly, the relatively modest Southeast Asia total of $270 million could be driven up by GPs targeting growth-stage funds.

However, even if India and Southeast Asia deliver on their near-term promise, their VC industries will remain far behind China. Market size is just one consideration. Investors can also point to the returns previously generated by China-focused managers and the wave of liquidity they expect to come over the next two years as the leading unicorns go public.

At the same time, China is a far more complex VC ecosystem than it was just five years ago, mainly due to a proliferation of new managers. Accessing top-tier funds remains a challenge because they are oversubscribed, but LPs that want to increase their exposure must also have one eye on how the market is evolving. Domestic of foreign affiliate? Independent or semi-captive? Generalist or sector-focused? Early-stage or late-stage? The choices have widened, but there are also more potential pitfalls.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.