India IPOs: Open window

Record public market valuations have facilitated a wave of private equity-backed IPOs on Indian bourses.

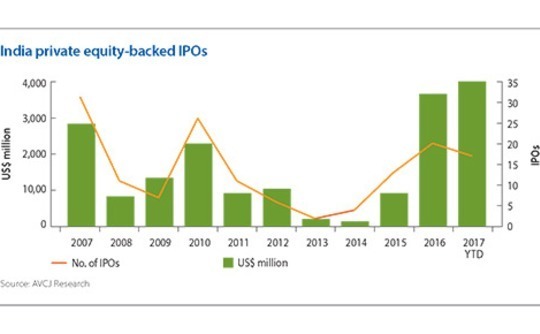

It was November 2015 and about a dozen private equity-backed companies had listed on Indian bourses since the start of the year – as many as in the three previous years combined. Proceeds were nearly three times the aggregate total for 2013 and 2014 (the 2012 figure was swelled by Bharti Infratel, which at that point was the second-largest PE-backed offering ever seen in the country).

Nevertheless, investors were skittish. "The windows are quite narrow. What usually happens is people get carried away when markets are doing well and they try to hold things longer to get a better return," was one response, the sentiments of which were shared by many. They also had a shopping list of suggested improvements, from speeding up listing approvals to encouraging more technology IPOs.

Fast forward 24 months and the window is very much still open. After 13 offerings generated proceeds of $919 million in 2015, 20 listings raised $3.6 billion the following year, and 17 have delivered a combined $3.9 billion so far in 2017. Two insurers, SBI Life and ICICI Lombard General Insurance, have contributed more than half of the proceeds, but several smaller offerings have performed strongly. It helps that the BSE Sensex, like many stock market indexes around the world, is at an all-time high.

India's bull run is in part the result of demonetization. Capital has been forced to flow from the informal to the formal system, i.e. keeping it stuffed in a mattress was no longer viable for retail investors. With gold and real estate no longer as popular as they once were and the returns on fixed income products no longer as high as they once were, public equities are the default option. Around $1 billion has been pouring in every month, negating the impact that foreign capital flows on the market.

However, the rising tide isn't floating all boats. While the supply of capital has grown, the number of attractive investment options hasn't necessarily changed that much. Large companies that constitute the bulk of the index are benefiting from the inflows, but move out of the top 200 and liquidity might still be an issue.

One of the observations made in 2015 that still holds true is that it is hard for some Indian companies to build scale, and the public markets tend to reward businesses with stability and meaningful size. Of the 17 PE-backed offerings for which AVCJ Research has records so far this year, six are currently trading below their IPO price. One of them is the largest, SBI Life, but four of the others listed at valuations below $400 million. They didn't all list at the same time, and the market has flattened since the start of November, but it seems more than a coincidence.

Ultimately, an IPO is not the best exit route for every company – no matter what the public market valuations suggest – and private equity investors should consider all their options.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.