China M&A: Common ground

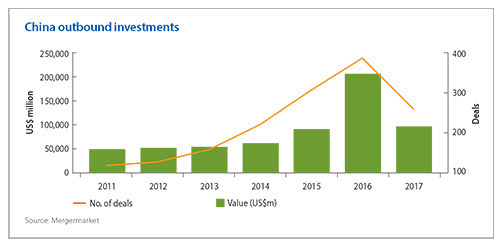

Chinese outbound M&A is stigmatized at the moment due to concerns about regulatory barriers both foreign and domestic, but buyers and sellers can reach mutually beneficial compromises

Did Fairchild Semiconductor International do its shareholders a disservice last year in choosing to reject a reject a $2.6 billion take-private bid from a Chinese consortium in favor of a lower offer from a US-based competitor? The company said there was an unacceptable level of risk that the Committee on Foreign Investment in the US (CFIUS) would veto the deal and that the consortium's proposed $108 million CFIUS reverse termination fee was not enough to justify proceeding.

Given Chinese buyers' patchy record when pursuing semiconductor assets in the US – most recently exemplified by the presidential veto of Canyon Bridge Capital Partners' purchase of Lattice Semiconductor – Fairchild might feel somewhat vindicated. But the question remains valid in other, less sensitive industries, where companies in the US and other Western markets might be accused of dismissing Chinese bids due to misplaced fears of a regulatory backlash.

The issue was raised by panelists participating in the China M&A Forum in Shanghai, with some suggesting that media coverage of the restrictions Beijing imposed on outbound capital flows towards the end of last year had created a false perception overseas that no Chinese buyer is good for the money. Rejecting bids out of hand is not the only course of action. The seller might instead place stringent conditions on any decision to move ahead, with requested down payments on deals said to be as much as 10% of the overall transaction cost.

Both sides can take steps to reach a compromise. If the board of a selling – and listed – company is to observe its fiduciary duty to shareholders, understanding the buyer and the buying process is integral to establishing whether the risks of accepting a higher bid really do exceed the returns. Panelists said they had on occasion taken Western companies through the Chinese approvals mechanism step by step, identifying the different requirements and the potential bottlenecks.

In other situations, Chinese outside counsel has been appointed in order to establish exactly what is possible under Chinese law. For example, understanding that asking for a down payment of more than 5% would trigger a raft of different domestic approvals for the buying company – to the point that pursuing the asset is no longer economic or practical – could save an auction process from collapse.

On the Chinese side, the most powerful action might simply be to establish strong relations with the management of the target company. If these channels can be used to explain the approvals process, how and from where the transaction will be financed, and what the buyer's intentions are for the company, a management team that is comfortable working with the new owner can transmit this good faith to the board.

Needless to say, these relationships can also pay dividends when it comes to identifying potential synergies between the two companies during due diligence and then executing strategies post-acquisition.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.