China M&A: Exit options

The growth in outbound M&A among Chinese investors has created significant exit opportunities for PE investors

Eight private equity firms have benefited from Wanda Group's global appetite for movie theaters, with the cumulative value of these deals – including debt – amounting to around $5.5 billion. The Chinese conglomerate's outbound push over the last five years through US-listed affiliate AMC Entertainment has created a platform with more than 1,000 theaters and 11,000 screens in 15 countries.

It started with the acquisition of US-based AMC from a four-member private equity consortium in 2012. Then, over a three-year period, AMC bought Starplex Cinemas from Trinity Hunt Partners in the US, followed by Europe's Odeon & UCI Cinemas from Terra Firma, and Nordic Cinema Group from Bridgepoint and Bonnier Holding. Another asset, Australia-based Hoyts Group, was acquired from Pacific Equity Partners by a subsidiary of Wanda's domestic movie theater business.

AVCJ Research has about half a dozen records of private equity firms selling non-Chinese portfolio companies to Wanda – and still more acquisitions have been made by Wanda-owned entities, including three of the five deals listed above. In addition, there have been three exits to Anbang Insurance and a handful each to HNA Group and different Fosun Group entities.

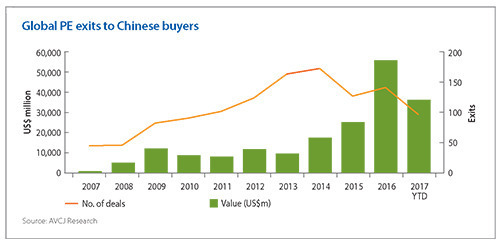

It should come as no surprise that PE investors around the world have generated ample returns from the boom in Chinese outbound M&A. In 2007, financial sponsors sold 45 assets to Chinese buyers for about $3 billion, according to AVCJ Research. By 2011, it had risen to more than $8 billion across 101 deals and then last year the total surpassed $55 billion across from 140 transactions.

The headline number for the first nine months of 2017 is strong despite China's clampdown on outbound capital flows, with $36 billion across 90-odd deals. However, China Investment Corporation's announced acquisition of Logicor from The Blackstone Group accounts for $13.7 billion of that on its own. It is more than twice what Blackstone got from HNA for a stake in Hilton Worldwide in 2016.

The likes of Wanda, Anbang, HNA and Fosun are logical targets for private equity firms running sale processes. These buyers have substantial resources and ready access to debt funding, and they have shown themselves to be aggressive in the pursuit of assets. That changed in June when China's banks were asked by regulators to provide information on overseas loans made to these four companies amid fears that their wanton deal-making presented a systemic risk.

It was subsequently reported that regulators had flagged up six recent transactions by Wanda – including AMC's acquisitions of Odeon, Nordic and Carmike Cinemas – that violated the capital outflow restrictions. AMC insisted that all its purchases were funded through US bank loans and cash, with no support from Wanda. Questions were also asked of Hilton amid fears that HNA would be forced to offload part of its stake in order to service debts.

China will inevitably play a larger role in global M&A in the long term and private equity firms will surely benefit from this. It just remains to be seen which groups emerge as the most active shoppers and what sort of assets they want to buy.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.