Australia exits: Closed window

Exit activity in Australia has followed a boom and bust pattern in recent years. Investors are consequently cautious about near-term IPO potential but not inactive

The distinct windows in which private equity firms can take companies public in Australia have familiar beginnings and endings. Following a period of relative inactivity, the market will flicker into life on the back of one or two strong IPOs. Then comes a time of plenty as a host of PE-backed businesses make it to the bourse, before the window snaps shut when an offering goes wrong.

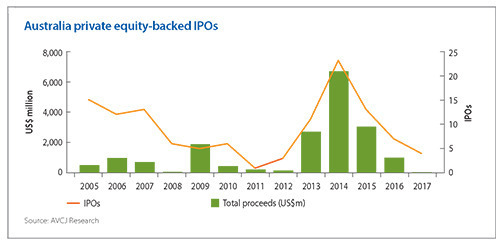

The uptick in listings between 2004 and 2007, when 56 companies raised more than $4 billion between them, was curtailed by the global financial crisis. However, Myer Holdings and Collins Foods – both of which slipped below their IPO prices after going public in 2009 and 2011, respectively – are blamed by many for the subsequent fallow period.

It took Virtus Healthcare to reignite the market in 2013 and then came private equity's biggest boom to date. A total of 44 IPOs were completed in the space of three years, with around $12 billion in aggregate proceeds. The bull run slowed and was then brought to a near standstill by the demise of Dick Smith Electronics, which entered receivership just over a year after Anchorage Capital Partners sold the last of its shares.

It is tempting to suggest that public market investors are subject to irrational swings in behavior that mirror media coverage. Most studies of IPO performance for mid-size offerings and above have found that companies with private equity backers have done better than those without in the years immediately after listing. But it's also true that a PE-backed blow up attracts a lot more attention than one in which there is no PE involvement.

Although the market remains open for a select group of companies – three private equity portfolio companies have completed offerings of $100 million or more since the start of 2016 – the environment is certainly challenging.

Craveable Brands and Zip Industries both tested investor appetite and found it lacking. The latter ended up being sold to a strategic investor, and M&A advisors note that recent trade sales involving Alinta Energy, Icon Group and Laser Clinics Australia might well have been IPO exits in more favorable conditions. They also report that dual track processes have been replaced by single track processes in certain cases, as PE investors accept the reality of the public markets.

The question on everyone's lips is when will sentiment turn, and few are willing to bet on it happening before 2018. The industry is not at crisis point because many of the investments made in the wake of the last IPO bonanza need more time before they are ready to come to market.

In the meantime – and in the absence of meaningful activity by Chinese strategic investors – secondary buyouts have come to the fore. Icon Group and Laser Clinics both ended up in the hands of new financial sponsors.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.