Private equity and data centers: Get connected

With demand for outsourced data center services poised to take off in Asia, private equity investors are looking for ways to participate in the growth story

Quadrant Private Equity secured a 3.4x multiple on Canberra Data Centers last year when it – and company management – sold a majority stake in the Australian data center provider for A$784 million ($565 million). It represents an attractive return on a less than two-year-old minority investment, but the industry may still have a lot of value to deliver. Frost & Sullivan projects Australia's outsourced data center market will be worth A$1.75 billion in 2020, up from A$830 million in 2014.

It is a similar story across Asia – and globally – as companies increasingly outsource their data center requirements. Why put up the capital required to build a data center, not to mention the costs and complexity of operating them in a climate of increasing regulatory scrutiny, when the responsibility can be handed off to a third-party colocation provider?

PE investors are responding to the opportunity, with a string of deals over the past 12 months. Goldman Sachs and TPG Capital led a A$400 million ($306 million) round for AirTrunk, a Singapore-based provider with regional aspirations, while Warburg Pincus invested $300 million in a technology, media and telecom buyout platform that will target data centers and digital media services in emerging markets. This followed an agreement between Warburg Pincus and internet services provider 21Vianet to develop and acquire data centers in China.

There has even been a liquidity event as GDS Holdings, which counts SBCVC among its investors, raised $192.5 million through a NASDAQ IPO in November. The company's largest external shareholder is ST Telemedia, an investment unit of Temasek Holdings that has a substantial global data center portfolio.

GDS offers a useful insight into the dynamics of the industry in China, which likely represents the single largest growth opportunity in Asia. As of year-end 2016, GDS had 10 self-developed data centers with nearly 52,000 square meters of space in use, operated 10 smaller facilities owned by third parties, and generated $152 million in revenue. It is the largest player in China's high-performance carrier-neutral data center market, yet its market share is below 20%.

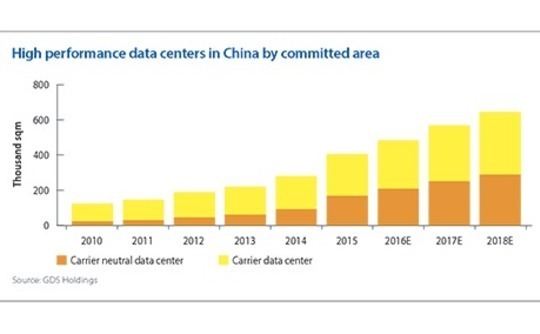

For context, the estimated total data center areas in service in China, including in-house enterprise facilities, was 7.4 million sqm. Outsourced colocation providers accounted for 1.2 million sqm of this, compared to 3.4 million sqm in the US. GDS cited projections in its IPO prospectus that the total committed area of high-performance data centers would rise from 403,000 sqm in 2015 to 642,000 sqm in 2018, about 45% of it carrier-neutral. Annual revenue is expected to hit $2.4 billion by this point.

The primary challenge faced by data center providers targeting expansion in emerging markets is uncertainty: they need substantial upfront capital expenditure to build new facilities and it is a relatively long wait before this starts paying off. Incumbent players benefit from some natural barriers to entry, but the industry's strong fundamentals are likely to continue attracting new platforms backed by private investors.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.