Information issues: Fund administration in Asia

Private equity firms in Asia are increasingly willing to outsource fund administration, but they appear to be slower than their global counterparts in embracing more sophisticated middle office functions

For most fund administrators, a desired business evolution scenario for Asia – and principally China – is as follows: A GP raises two or three funds, relying solely on friends-and-family money at first and adding a sprinkling of institutional capital later on. Fund IV involves a step up in size, and hopefully in LP quality as well, and the back office requirements reach the point where there is no desire to continue performing these functions in house. So the GP outsources these services to an administrator.

Beyond areas such as custodian services, to outsource or not to outsource is traditionally viewed in the context of size, resources and habit. And outsourcing is generally on the rise in Asia, as investor bases become more international, investors seek larger amounts of information from managers, and greater regulation adds weight to the administrative burden.

The 2017 edition of fund administrator Augentius' annual global survey of private equity fund managers appears to confirm this trend. Across compliance, fund administration, regulatory reporting, taxation and legal services, the percentage of Asian respondents expressing a willingness to outsource is not particularly out of step with the Americas and Europe, the Middle East and Africa (EMEA). Indeed, in all bar fund administration, Asian managers have more intent to outsource than their EMEA counterparts.

But how far are private equity firms in this region are willing to go in order to deliver consistency, standardization and automation? Is there, for example, growing demand for middle office and front office reporting – systems that slice and dice portfolio specific data to show how capital from a particular LP has been allocated across different deals, geographies and sectors? Anecdotal evidence suggests many GPs find these costs harder to justify.

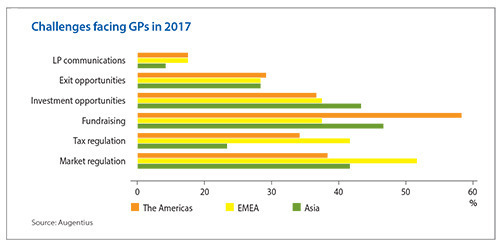

Asked whether they were planning to modernize and develop their internal processing in 2017, 30% of Asian respondents answered in the affirmative, compared to 60% in the Americas and 55% in EMEA. Peculiarly, the 2016 figure for Asia was 50%, roughly in line with other markets. In another part of the survey, Asian GPs indicated they saw less of a challenge in LP communications than their Americas and EMEA counterparts. Investment opportunities, fundraising and market regulation are by some distance their biggest concerns.

LP respondents were also less worried about GP-LP communications than other issues, although their biggest administrative frustrations are lack of transparency around fees, late reporting and insufficient detail in reporting. The latter two have separately been described as areas in which some LPs – attitudes can vary considerably – are likely to give Asian GPs a break, prioritizing market access over seamless delivery of information. It remains to be seen how long this lasts.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.