China venture capital: Contrarian view

While capital is widely available in China's VC scene, investors continue to worry worry that the market is not developing as it should

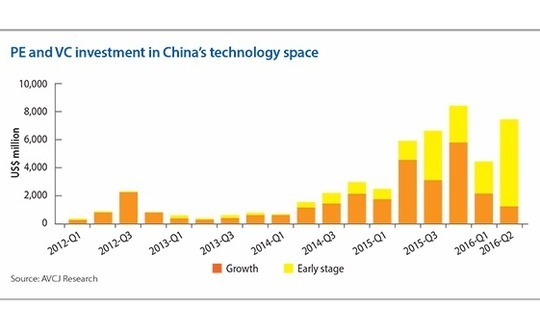

Capital continues to pour into China's technology space, anecdotal evidence of a slowdown notwithstanding. A total of $7.4 billion was deployed in early and growth-stage technology deals between April and June of 2016, the second-highest quarterly figure on record. Meanwhile, venture capital fundraising rebounded from a relatively weak first quarter to hit $2.2 billion for April-June.

Admittedly, much of this activity is highly concentrated. Most of the capital invested went into a handful of large rounds for the likes of Ant Financial. As for fundraising, GGV Capital's $1.2 billion for three vehicles was responsible for more than half the total. But even if investors have become more selective, appetite for the asset class remains strong. In this context, an argument recently put to AVCJ by one LP for not investing in China venture capital offered an interesting, long-term perspective.

This particular institution is US-based, VC-heavy, and not obliged to invest in Asia. Most of its capital is with a collection of North American GPs focusing on IT and life sciences. China came into consideration in 2007-2008 when the US venture capital industry was in poor health. Using local partners to assist with due diligence, commitments were made to a small number of managers that invested in start-ups at a relatively mature stage, with IPO exits seemingly not far off.

"We have made money there but not as much as we should have for the risk we took," is the LP's view. There have been no new investments in China venture capital since that vintage and no plans for any in the future. Criticisms of the market fell into two categories: lack of exits and lack of transparency.

The exits gripe is long-standing and widely-voiced. In 2010 and 2011, 41 private equity and venture capital-backed Chinese companies went public on NASDAQ and the New York Stock Exchange; only 25 have followed them in the four full years since then. Shanghai and the various Shenzhen bourses have been equally flaky, an explosion of activity between 2010 and 2012 turned into a year of regulator-enforced fallow in 2013 and then a more measured - and carefully scrutinized - pace of issuance.

The lack of transparency is intertwined with the uncertainty over exits. In the past 18 months alone, China has seen two bouts of extreme volatility, one of them triggered by regulatory naivety, and a short suspension of new listings. From an LP perspective, it is difficult to know where market sentiment or regulatory whim might turn next.

Meanwhile, the rise of the National Equities Exchange and Quotation (NEEQ) is bewildering; and the removal of variable interest entity (VIE) structures by some companies in order to facilitate domestic listings - and the cashing out of offshore VC funds if direct foreign exposure to the industry is not permitted - is disconcerting.

These restructurings might deliver a 2x return when an exit otherwise looked uncertain, but the LP was adamant: "I want to be paid for taking China risk and that means more than 4x." While this view does not speak for everyone, it explains why China's technology space, despite its rapid growth, is still too green for some.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.