Deal focus: Longreach hits homerun with Quasar

The Longreach Group transitioned Quasar Medical to professional management, took it into new markets, and diversified the company’s manufacturing footprint. A 7x return was its reward

Whenever The Longreach Group makes an investment outside of Japan, its core geography, there is some kind of Japanese nexus – usually sourcing technology or tapping clients that wouldn't otherwise be within reach of the target company. This was part of the pitch when the GP acquired Hong Kong-headquartered medical devices manufacturer Quasar Medical in 2019.

"There was a process, but Longreach persuaded the founders that it could bring a different set of capabilities that would help grow the business, including Japan market entry. The founders turned down more attractive offers on that basis," said a source close to the situation.

Over the next four years, revenue and EBITDA each grew approximately threefold, while the EBITDA margin rose from 15% to over 20%. This laid the groundwork for a recent USD 660m sale to Chinese private equity firm Boyu Capital.

Longreach, which owned 86% of the business, has made back 7x its money and returned nearly the entire corpus of the fund that made the investment, according to information shared with LPs. Longreach declined to comment.

Quasar was established in 1988 by an Israeli family that moved to Hong Kong in the prior decade. The company has engineering capabilities in Israel and manufactures out of China and Thailand, but the customer base was global from day one. It serves medical device original equipment manufacturers such as Johnson & Johnson, Medtronic, Terumo, Abbott Laboratories, and Boston Scientific.

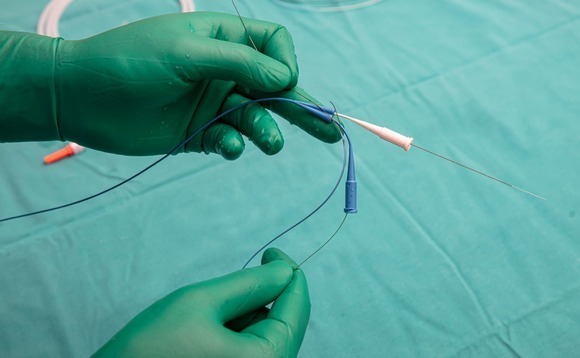

The core product line comprises minimally invasive cardiovascular catheters. Quasar develops customised electromagnetic microsensors designed to sit at the tip of catheters and guide entry into the body. A balloon situated further up the catheter is typically used to open narrowed or blocked arteries. The company produces 2.3m sensors every year.

Quasar also supplies an assortment of complementary products, ranging from disposable devices such as respiratory tube sets to electronic devices like blood pressure monitors and pulse oximeters.

Micro-assembly minimally invasive consumables is one of the fastest-growing areas in global medical technology. Quasar and Bain & Company estimated that the segment, currently worth USD 4bn, will see compound annual growth of 20% through 2027. This compares to 6% for the med-tech generally.

Ageing populations, improved diagnosis and treatment rates, and an increasing reliance on outsourced manufacturing are all contributing factors, but surgeons are also pursuing minimally invasive procedures in greater numbers, won over by faster recovery times and fewer complications. By extension, there is growing demand for micro-assembly as devices become smaller and more complex.

Three-quarters of the global market is taken up by contract development and manufacturing organisations (CDMOs) that generate less than USD 50m in annual revenue. Quasar was at the upper end of this category when Longreach invested. Now, the company is firmly established as one of approximately 10 players with USD 50m-plus in revenue that account for the remaining 25% of the market.

Boyu overcame competition for the asset from the likes of Hillhouse Investment, BPEA EQT, CVC Capital Partners, FountainVest Partners, and General Atlantic, the source noted. There was also interest from strategic players, including Thailand-based Innobic.

On acquiring Quasar, Longreach had to transition the business from family ownership to professional management. This meant appointing the first non-family CEO as well as creating or augmenting other executive-level functions. It also tweaked the product mix and customer base – Japan entry was one part, US expansion was another – and sought to deepen and diversify relationships with existing blue-chip clients.

Another value creation initiative involved diversifying the manufacturing footprint. Quasar previously only had a single factory in Dongguan, China. The company hasn't turned its back on the country – a satellite facility was added in the same area to alleviate capacity pressure – but a factory was established in Thailand to address the supply chain concerns of multinational customers.

"They don't necessarily want to shift manufacturing out of China; they know that, for the time being, China is the most cost-efficient place for precision manufacturing. However, they want to de-risk from China and move away from single-source suppliers," the source explained.

"The company is now positioned to build revenues towards the USD 200m-plus range, and it could feasibly reach USD 1bn."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.