Deal focus: Gitai turns robot economics on its head

Japanese start-up Gitai eschews conventional wisdom that industrial-use robots must be specialized. Its Series B round will be used to build general-purpose robots for use in space

Specialized robots make sense in the business world. They're mass production-ready, high-accuracy, high-performance, and relatively low cost. But Sho Nakanose, CEO of Japanese space robot developer Gitai, isn't interested.

Gitai prefers high-cost, low-volume general-purpose robots. Unlike other industrial-use robots, they don't do any specific manual tasks as well as a person, but they make up for it with versatility. This is a key strength in an environment as unpredictable and difficult to access as space.

Perhaps most crucially, unlike human beings, once they go up, they don't have to come down. In some instances, this is expected to create hundredfold operational savings for space companies.

"Most entrepreneurs try to replace labor costs with robots, but that's not good business for us. We focus on transportation costs," Nakanose explains. "The labor cost for an astronaut is $400 million a year, and 90% of that is transportation."

Gitai raised a JPY1.8 billion ($17 million) Series B round last week from a group of local VCs including Global Brain and Sparx Group. It follows several operational milestones, including a successful ground-based equipment test, as well as project development partnerships with JAXA, the Japanese space agency, and Toyota, the largest LP in Sparx's Space Frontier Fund.

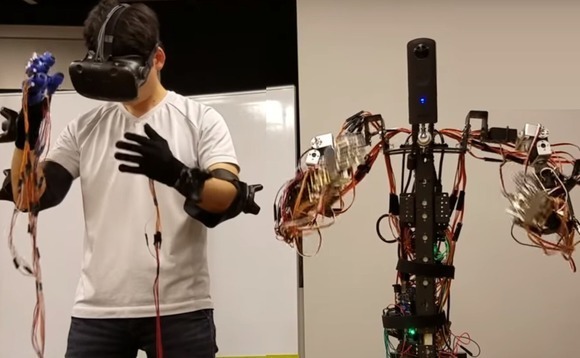

The start-up's core products include a humanoid avatar that can be remote controlled with goggles and hand sensors. The robot, called GI, is expected to perform various tasks inside and outside orbiter vehicles and on the surface of the Moon. It costs about $300,000 per unit, featuring camera eyes, wheel-based mobility, and pragmatic pincer hands.

"The general-purpose robots that have been designed by space agencies had five fingers, which looks good, but they're easy to break and difficult to maintain," Nakanose says. "That's why we use a gripper hand. Researchers don't like that, but we try to be more practical."

Go-forward plans include the company's first in-orbit equipment test in August; Nakanose notes that transportation costs – SpaceX is the expected carrier – are largely being handled by NASA. These connections dovetail nicely with a key expansion priority, which is to do more business in the US.

Longer-term ambitions are decidedly dramatic – helping build colonies on the Moon and Mars – but most foreseeable contracts will be in areas such as orbital debris cleanup and spacecraft maintenance. In time, satellite repair may prove to be the company's biggest market. Commercial satellites can cost up $450 million to install but have a maximum lifetime of only 30 years. Repair jobs could theoretically be done for as cheap as $40 million.

Gitai intends to embrace this niche with a continued preference for general-purpose over specialized robots. Development is underway for equipment-to-equipment interface hardware that can be affixed to a multi-use arm. The idea is that clients will attach compatible interfaces on their satellites prior to launch to facilitate docking when needed.

"There actually isn't any way to repair a satellite currently. It's just one-way," Nakanose says. "If it breaks, it just becomes debris."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.