Deal focus: Monetizing mice

ORI Capital’s 2.8x return on its investment in Kymab was in part based on helping the company make the transition from antibody-based discovery platform to drug development engine

Simone Song's deal sourcing network is professional and personal. The Goldman Sachs investment banker-turned-healthcare venture capital investor first learned about UK biotech specialist Kymab from one of her LPs as well as from her father. Having a member of the Chinese Academy of Sciences – and a recognized pioneer of the domestic biotech industry – in the family can be useful.

"My father said, ‘There's no doubt, this company has the best fully humanized antibody platform from which you can produce a range of antibodies to deal with very challenging diseases,'" Song recalls, adding that Kymab's introduction to her father came through a UK government agency.

ORI Capital, the VC firm she established in 2015 after a health scare prompted a career change, led a $100 million Series C round for Kymab via its $200 million debut fund. The LP – Shenzhen-based Hepalink Pharmaceutical – took part as well. They were joined by existing investors Wellcome Trust, Bill & Melinda Gates Foundation, Malin Corporation, and Woodford Investment Management.

Last week – just over four years since the Series C – French pharma giant Sanofi agreed to buy Kymab for $1.4 billion, comprising $1.1 billion upfront and $350 million to be paid on the achievement of certain development milestones. ORI will deliver a 2.8x return on its investment. The VC firm announced a $112 million first close on Fund II, which has a target of $400 million, at the same time.

Kymab will be the second exit from Fund I, following the $1 billion acquisition of Semma Therapeutics by Vertex Pharmaceuticals in 2019. Together, they will propel distributions to paid-in (DPI) to 80% by year-end, Song says, with six more companies yet to be exited.

Early mover

ORI's portfolio consists of innovative early-stage companies that address high-mortality diseases – Semma targets type-one diabetes, Kymab is an immunotherapy specialist – across diagnostics, drug delivery, and therapeutics. The venture capital firm is stage and geography-agnostic, but its value proposition to start-ups is often assistance with China expansion.

Song can certainly claim a relevant lineage; her mother, as well as her father, is a scientist of note, having developed China's first top-line novel biotech drug with independent intellectual property rights. Song herself led healthcare investment banking for Greater China at Goldman.

However, ORI has sought to add systemization to its contacts-led deal sourcing through an in-house artificial intelligence-enabled analytics platform that tracks 10,000 companies, 1,000 fund managers, and key opinion leaders. It is a selling point for those who want to understand competitive threats, from other VC firms to start-ups plotting their future. Kymab falls into the latter category.

"The AI system not only helps us choose the right investment target, it also raises the intelligence of our companies in terms of understanding competing technology, what big pharma is doing, and what their strengths are," says Song. "It helped Kymab see the competition much more clearly. In clinical design, you have to understand what disease profile to go after."

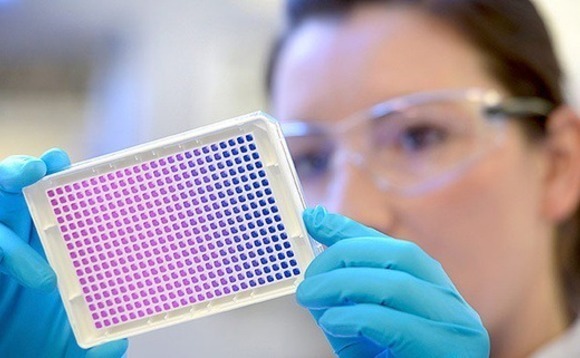

When ORI first met the company, it had the antibody platform that impressed Song's father. This is underpinned by the Kymouse, a genetically engineered mouse that can generate any antibodies that humans produce, so it becomes the reference framework for antibody humanization. This simplifies and de-risks the testing process for new drugs, while providing accurate results.

Creating a full set of human antibody genes involves moving segments of DNA into the mouse genome, one by one, and reconstructing them in the right way. Kymab argues that its technology is superior to others in that it can handle large stretches of DNA and form the building blocks for mature antibody drugs. "Every carmaker says, ‘I have a car,' but is it a Rolls-Royce?" Song asks.

Having developed Kymouse, Kymab extended its platform to include single B cell sequencing and offer insights into how antibodies can be applied in immunotherapy. This was a logical progression given the team's scientific grounding. The company was founded by Allan Bradley, a professor of genetics who contributed to Nobel Prize-winning research into the use of stem cells to modify mouse genes. He continued this work at the Wellcome Trust Sanger Institute.

Building a pipeline

What Kymab lacked in 2016 was its own pipeline of drugs. ORI assisted the transformation from discovery engine to development engine, with Song observing that Bradley "is a brilliant scientist, but a scientist is not a drug developer." A new CEO was recruited from Merck Group as well as a full development team, including a chief marketing officer, scientists with a grasp of specific drug profiles, and manufacturing and regulatory experts.

"I flew to the UK four times in six months to help interview potential CEOs, change the budget, and get the board aligned," Song explains. "The art of the game is to focus. We looked at the expertise of the team, and they are all immunologists, so we focused on immunology for our clinical candidates."

The number of candidates was reduced to three, of which the most valuable is KY1005, a treatment that addresses overaggressive immune systems, blocking the proliferation of inflammatory cells without suppressing the broader immune system. It is in phase-two clinical trials. The other treatments are both anti-cancer drugs.

Song notes there is "no way the valuation can go from $200 million to $1.4 billion unless the transformation [to development engine] takes place," but she warns that it is foolhardy to expect immediate results. The shortest possible timespan to move from discovery to clinical trials is 18 months and this is a rarity. As such, the presence of sophisticated, patient investors is important.

Around 90% of the exit transaction value is tied up in KY1005, which Paul Hudson, CEO of Sanofi, describes as "a potential first-in-class treatment for a range of immune and inflammatory diseases." But the company is also acquiring the technology infrastructure from which the monoclonal antibody that forms the basis of the drug originated. This infrastructure can help Sanofi identify a wealth of new treatments.

"They are getting the platform and the pipeline, and it's the best platform in the world," says Song.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.