Deal focus: UTEC positions Tricog for Japan expansion

University of Tokyo Edge Capital built an unusual bridge between the start-up worlds of Japan and India when backed Tricog's artificial intelligence-enabled healthcare solution

Noriaki Sakamoto, a partner at Tokyo-based University of Tokyo Edge Capital (UTEC), first met interventional cardiologist Charit Bhograj in 2017 at a conference in Japan. Sufficiently impressed by the doctor's tech-enabled venture, UTEC participated the Tricog's Series A funding round the following year.

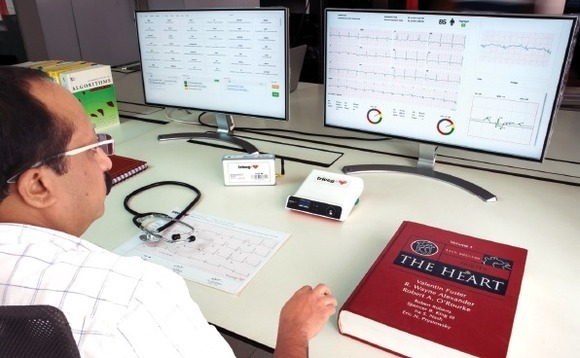

Bhograj's team had built a diagnostic device called InstaECG that analyzes electrocardiogram (ECG) reports. The capital from UTEC helped scale the operation beyond its home market of India. InstaECG is now used by 2,500 medical institutions in 12 countries in Africa and Asia.

The cloud-connected device uses an artificial intelligence (AI) algorithm to speed up the analysis of ECG reports. It now has a treasure trove of data points and has made a difference to remote clinics and underfunded hospitals that might not have a cardiologist on call. "Many AI start-ups need to pay to collect the data but what's beautiful about Tricog is how they collect the data while getting paid. Because they operate in India and Africa, it's easier for them to collect data in such a short period of time," says Sakamoto.

Cardiological experts verify the findings at the main office in Bengaluru. Tricog's vast database – it says it has already produced three million ECG reports – means the reports already demonstrate a high degree of accuracy.

Now, Sakamoto has introduced Tricog to other Japanese investors. Aflac Ventures, the corporate venture arm of the American health insurer with a significant presence in Japan, and Dream Incubator recently participated in a $10.5 million Series B round. UTEC has also connected the company with local equipment manufacturers in the hope of commercializing the solution in Japan. In India, Wipro GE Healthcare is the ECG device manufacturer that handles enterprise sales for the start-up.

Targeting Japanese hospitals involves careful planning to find a suitable product-market fit. Not only are conditions like strokes and heart attacks less common in developed markets, the business environment is different, Sakamoto says. Bhograj's team will need to work on solutions that tackle other types of cardiovascular problems.

"The use of AI for medical diagnosis in developed countries is different to the rest of the world. Enabling remote patient monitoring especially among ‘super-aged' populations to prevent late hospital admissions is a possible use-case," says Sakamoto. However, he believes Tricog can get traction in more remote parts of the archipelago with its low-cost cardio-analytics solution.

Founded in 2004, UT-EC is the product of one of four venture capital partnerships between the Ministry of Economy, Trade & Industry (METI) and local universities. It currently has 57 active investments mostly in start-ups incubated in Japanese universities. Tricog, however, fulfilled the university-linked venture firm's impact investment mandate.

In India, UT-EC has only invested in two healthcare firms. Its involvement in India's technology sector could accelerate after it partnered with India-based Blume Ventures to launch a seed-focused accelerator program last year.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.