PE-backed Concord Healthcare pursues HK IPO

Concord Healthcare Group, an onshore subsidiary of US-listed Chinese healthcare business Concord Medical, has filed for an IPO in Hong Kong.

Concord Medical holds a 40.5% stake in the business. Other investors include CICC Capital and CITIC Industrial Investment – a subsidiary of CITIC Group – which own 17.73% and 11.49%, respectively. Gopher Asset Management has 5.2%, while Morgan Creek Asset Management has a stake of undisclosed size.

CICC Capital, the private equity arm of China International Capital Corp, agreed to invest up to CNY 1.8bn (USD 286m) in Beijing Meizhong Jiahe Management, a Concord Healthcare subsidiary, in 2018. It also participated in pre-IPO funding rounds for Concord Medical alongside The Carlyle Group and C.V. Starr.

In 2016, an investment vehicle controlled by Jianyu Yang, Concord Healthcare's chairman, offered to privatize the US-listed business at a valuation of around USD 224m, having agreed to buy Carlyle's interest. Morgan Creek joined the bidding consortium. The offer was withdrawn in late 2017.

CITIC Industrial provided the entirety of CNY 700m Series B in 2020. Series C and D rounds of CNY 400m and CNY 300m came in mid-2021 and last June, respectively. The latter valued the business at CNY 7.2bn.

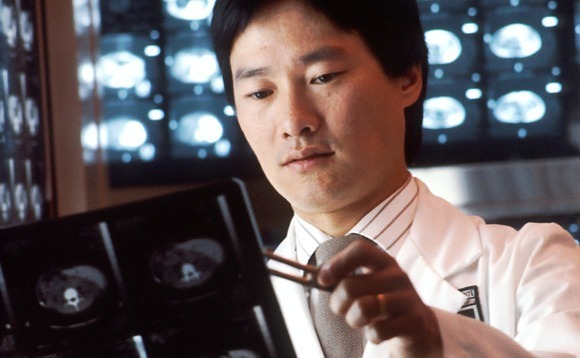

Concord Healthcare is active in the research and application of advanced oncology diagnostic and treatment technologies, distinguishing itself as one of the few private operators in China with multiple proton therapy treatment rooms. Proton therapy refers to a cancer radiation treatment that uses protons instead of x-rays.

Assets include seven self-owned medical institutions in operation across Guangzhou, Shanghai, and Datong. This includes two cancer hospitals, three outpatient departments and clinics, one imaging diagnosis center, and one internet hospital, a telehealth and patient education service. A third cancer hospital is under construction in Shanghai.

Operations also encompass a network of third-party medical institutions and various online services. A cloud services offering, primarily targeted at expanding coverage into lower-tier cities, is credited with a significant increase in enterprise customers in recent years. As of June, the company had supplied 17 partner hospitals with cloud services and related operating leases, according to a prospectus.

The plan is to further develop the proton therapy offering, cultivate a global oncology brand, upgrade cloud and software-related business lines, and advance scientific R&D. The company said it also aims to broaden its service portfolio and patient touchpoints with its internet hospital.

Revenue was up marginally during 2022 at CNY 472m, although this represented a 184% increase versus 2020. The net loss widened from CNY 591m in 2020 to CNY 831m in 2021 and narrowed to CNY 637m in 2022. During the first half of 2023, revenue came to CNY 285m.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.