Endeavour exits Japan automotive components maker

Japanese GP Endeavour United has exited local automotive components maker Crefact to local strategic Hiruta Kogyo for an undisclosed sum.

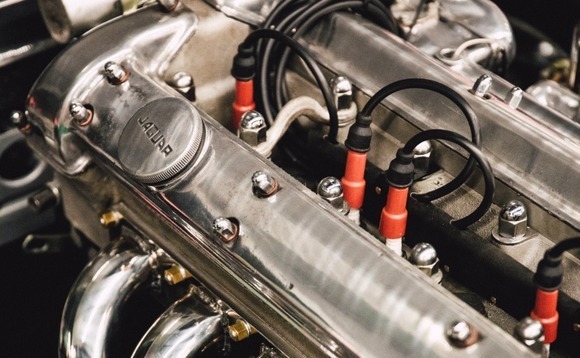

Endeavour acquired Crefact, then known as Sankei Industry and Sankei Kogyo, in July 2018. The company manufactures exhaust systems, fuel tanks, and other automotive body partners. Technical expertise spans sheet metal forming, pipe processing, electrostatic painting, and various types of welding.

"Crefact has advanced manufacturing capabilities to meet stringent demands from the market on the purification of exhaust gases and noise reductions, as well as requirements from leading Japanese automotive OEMs [original equipment manufacturers]," BDA Partners, Endeavour's advisor on the deal, said in a statement.

It comes as Hiruta Kogyo, like many automotive suppliers, advances a transition to equipment tailored to electric vehicles (EVs). Crefact's existing EV offering includes busbars for containing batteries, a business line BDA noted would be expanded under the new ownership. Crefact is also active in R&D on miniaturisation and weight reduction to install other components in EVs.

Indeed, Crefact's rebranding following Endeavour's acquisition came with a mission statement reboot featuring a strong focus on the UN's sustainable development goals (SDGs), auto industry electrification, and realising carbon neutrality more broadly.

Crefact has received ISO accreditation for environmental management systems and it has committed to reducing emissions at its factories. The company is also required to share environmental information with local communities and governments.

Additional developments during Endeavour's holding period include the establishment of partnerships with auto suppliers NHK Spring, J-Max, and Nisshinbo. Last year, a second factory was launched.

Endeavour was formed in 2013 as a subsidiary of Phoenix Capital, a turnaround investor founded in 2002. It closed its first two funds on JPY 22.7bn (USD 155m) and JPY 35.1m in 2016 and 2018. A third vintage, styled Fund IX in recognition of the history with Phoenix, closed on JPY 53bn last month.

The private equity firm focuses on small and medium-sized enterprises, targeting business succession, carve-out, and take-private opportunities as well as recapitalisation and revitalisation situations. In addition to manufacturing, focus areas include construction, wholesale and retail services, advertising and marketing, and corporate services.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.