Korean investors pump $150m into fuel cell maker HyAxiom

Korea Investment Private Equity, KDB Investment–Hana Securities, and KB Asset Management have led an investment of approximately USD 150m in HyAxiom, a fuel cell manufacturer controlled by South Korean conglomerate Doosan Group.

The transaction, structured as a private placement of convertible preference shares, will support R&D and business development activities as HyAxiom looks to expand its US and global operations while pushing forward with an electrolyser system, according to a statement. Electrolysers are used in green hydrogen production and in vehicle fuel cells.

The investment underlines growing interest in alternative fuels. Green hydrogen refers to hydrogen produced by electrolysis, a clean method for separating hydrogen from water molecules that use 40% less power than conventional technologies. It most often features in the chemicals industry, especially ammonia and fertilizers, although use cases in alternative fuels are developing rapidly.

Korea is already a leader in battery manufacturing globally and there have been numerous private equity investments in companies that produce components for electric vehicle (EV) batteries and energy storage systems. Some GPs have even launched strategies focusing on this space.

US-based HyAxiom was previously a division of United Technology Corporation and its fuel cells powered and provided water for lunar missions under the Apollo space programme in the 1960s. Doosan Group acquired the business out of bankruptcy in 2014.

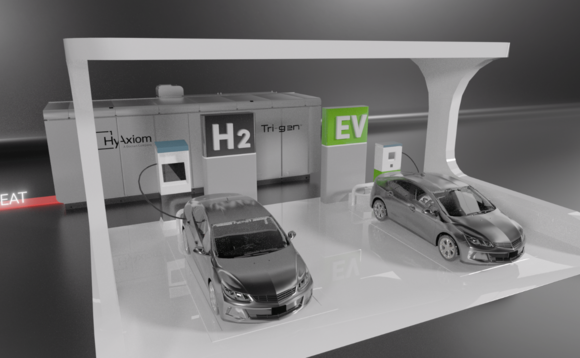

The company supplies stationary fuel cells and electrolysers to utility, industrial and commercial customers seeking cleaner and more sustainable sources of energy. The current product lineup ranges from electrolysers for scalable green hydrogen production and fuel cells for mobility applications, including long-haul maritime transport, buses, trucks, and other heavy-duty commercial vehicles.

HyAxiom claims to operate the world's first and largest stationary fuel cell power plant that runs on direct hydrogen. The facility, which has a capacity of 50 megawatts, entered commercial service in Korea in 2020. It is powered by a hydrogen-fuelled variant of HyAxiom's PureCell M400.

PureCell technology is based on phosphoric acid fuel cells that typically run on natural gas. HyAxiom deployed around 50 MW of total generation capacity in the US between 2010 and 2022.

"This investment comes at a critical juncture, as we finalise the development of new clean energy solutions and move towards commercialising these offerings, including our first electrolyser system," said HyAxiom CEO Jeff Hyungrak Chung. He added that the new capital would enable the company to take advantage of the recently announced US national clean hydrogen strategy.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.