Bain buys Japan software player IDAJ

Bain Capital has acquired IDAJ, a Japan-based engineering solutions provider that provides digital platforms to facilitate project development and computer-based design simulation systems.

The size of the investment was not disclosed, but local media reported the private equity firm paid approximately JPY 20bn (USD 147m). Bain is active in Japan through its pan-Asian funds – the fifth is currently in the market with a target of USD 5bn – and its mid-market country fund, which closed on JPY 110bn in 2021.

The private equity firm said in a statement that it would work with IDAJ's founding family to strengthen the business foundations and accelerate growth. It described IDAJ as one of Japan's few end-to-end service providers with top-level technical expertise in model-based definition (MBD) and computer-aided engineering (CAE) software. The company's primary clients are in the automotive sector.

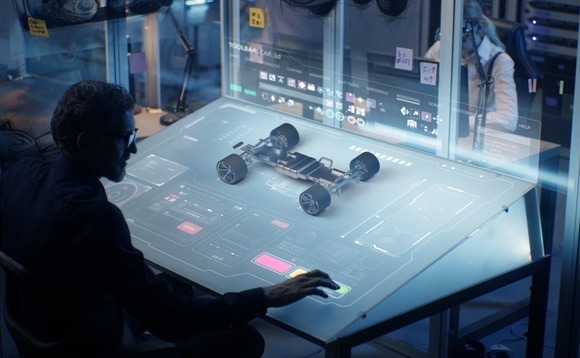

Founded in 1994 and headquartered in Yokohama, IDAJ combines its CAE offering with 3D computer-aided design (CAD) and computer-aided manufacturing (CAM). The goal is to use digital engineering techniques to analyse and predict product performance in advance, so that less time and cost are lost during the traditional repeated cycle of design and prototype creation.

The company's technology uses virtual products to evaluate a wide range of designs in complicated physical phenomena. It runs simulations that assess product reliability across systems architecture, 3D designs, thermal management, electromagnetic output, and acoustic noise. This feeds into CAD and CAM software that helps manage the engineering process.

The MBD platform centralises product development across different departments, enabling companies to identify potential problems and take remedial action at an early stage. Additional functionality includes robotic process automation (RPA) and embedded software development.

Bain has previous experience investing in Japanese software developers. In 2019, it acquired Works Human Intelligence (WHI), an HR software provider, for around JPY 100bn. Earlier this year, GIC invested in the business - taking joint control alongside Bain - at a reported valuation of JPY 350bn.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.