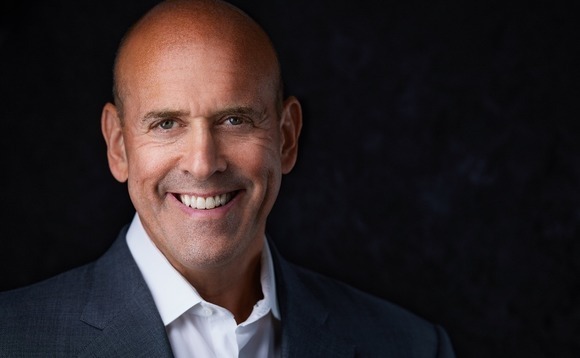

Carlyle names Harvey Schwartz as CEO

The Carlyle Group has appointed Harvey M. Schwartz, formerly president and co-COO of Goldman Sachs, as its new CEO.

He replaces Kewsong Lee who resigned in August after five years in the role. Lee was also an external hire, having been recruited in 2013 after a 21-year career at Warburg Pincus. Bill Conway assumed CEO duties on an interim basis; he will now step down while retaining his role as co-chairman.

Schwartz joined Goldman in 1997 and held several leadership roles, including in the securities and investment banking divisions. He was named CFO in 2012, overseeing critical financial and risk management processes as well as capital allocation strategy, and became president and co-COO in 2016, according to a statement.

Since retiring from Goldman in 2018, Schwartz has served in several non-executive roles. He is currently group chairperson of The Bank of London, a clearing and payments bank, and on the board of SoFi Technologies, a San Francisco-based financial technology company.

The transition to Lee and Glenn Youngkin, who served as co-CEOs from 2017 through 2020 when Youngkin retired, was billed as an exercise in succession planning. Founders Conway, Daniel D'Aniello, and David Rubenstein scaling back their involvement. Conway and Rubenstein took on the chairman role, while D'Aniello became chairman emeritus.

As of June, Carlyle had USD 369bn in assets under management, including USD 260bn in fee-earning assets. Private equity exposure amounted to USD 164bn, with USD 141bn in credit, and USD 63bn in global investment solutions, which includes fund-of-funds, secondaries, and co-investment.

Carlyle has a sizeable presence in Asia, which accounts for 10 of its 26 offices globally. The firm is currently in the market with its latest flagship pan-regional buyout fund, seeking USD 8.5bn.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.