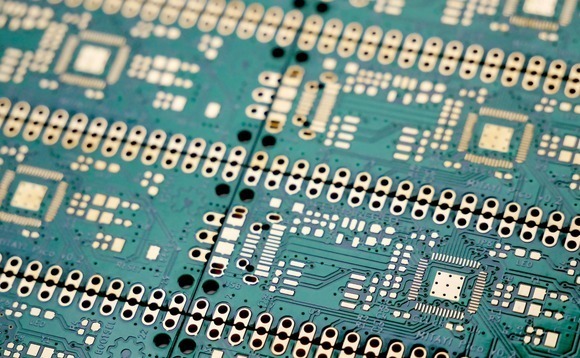

China semiconductor player Eswin Material raises $576m

Eswin Material, the integrated circuit manufacturing unit of Eswin Technology Group, has raised CNY 4bn(USD 576m)in Series C funding led by the New Materials Fund of China National Building Material.

Other investors include Yufu Holding, Beijing-based Financial Street Capital Group, China Fortune-Innovation Capital, Source Code Capital, SDIC Venture Capital, Guangtou Capital Management Group, and Hudson Capital. Existing backers China Life Private Equity Investment, China Zhongji Investment, and Puyao Capital re-upped.

The company announced at the end of 2021 that it has secured CNY 2.5bn in Series C funding led by Goldstone Investment and China Internet Investment Fund Management. This followed a CNY 3bn Series B announced in July 2021. An initial tranche of CNY 2bn closed about 12 months earlier.

Eswin was founded in 2016 and is led by Dongsheng Wang, who founded display company BOE in 1993. He is regarded as a pioneer in China's semiconductor display industry.

Eswin initially focused on integrated circuits and services in three core areas: display, artificial intelligence (AI) data processing, and wireless connectivity. Application areas include mobile devices, smart homes, smart transportation, and industrial internet-of-things.

However, the company then shifted focus from chip design to chip manufacturing. It is now one of the few companies in China that can produce 12-inch large silicon wafers.

The first phase of production, launched in July 2020, had a monthly capacity of 300,000 units, more than any other domestic manufacturer. Phase two is currently under construction. It is expected to lift overall capacity to 1m pieces per month, lifting the company into the top six globally.

Other investors in Eswin include Shangqi Capital, China Development Bank Venture Capital, China InnoVision Capital, IDG Capital, Legend Capital, CITIC Securities Capital, Shaanxi Financial Holding Group, Addor Capital, ZWC Management, Beijing Singularity Power Capital, and Triniti Capital, according to AVCJ Research.

Lighthouse Capital Group served as the exclusive financial advisor for the Series C round.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.