Horizons leads Series B for Australia healthcare AI start-up

Horizons Ventures, the private investment arm of Hong Kong billionaire Li Ka-Shing, has led a A$129 million ($92.3 million) Series B round for Australia’s Harrison.ai, a clinical artificial intelligence (AI) developer.

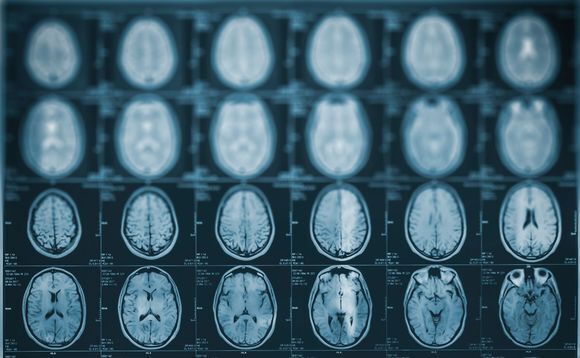

Horizons said it was impressed with the company's ability to quickly commercialize healthcare AI. Its investment follows the launch of Annalise, an AI product that supports decision-making for more than 350 radiologists a day at 250 clinics across Australia.

Annalise was developed last year in partnership with I-Med Radiology and commercialized in x-ray applications within 18 months. Its AI was trained using nearly one million chest x-rays and is said to be capable of detecting 124 anomalies to support and improve radiologist findings. This compares to 75 clinical findings for the next most comprehensive chest x-ray AI system.

I-Med, a local diagnostics imaging specialist that Permira acquired from EQT for $1 billion in 2018, is also investing in the Series B alongside Blackbird Ventures, Skip Capital, and Sydney-listed diagnostics player Sonic Healthcare. It follows a $29 million Series A in 2019 featuring Horizons, Blackbird, Skip, and Ramsay Health Care, one of Australia's largest private hospital operators.

The capital will be used to hire more data scientists and engineers and expand the business into new healthcare verticals with global clinical partners. A joint venture with Sonic focused on pathology-related AI was agreed concurrent with the investment to advance this agenda. Pathology, like radiology, is an area that suffers from severe skills shortages, making AI necessary to scale operations.

"Delivering equitable, effective and accurate healthcare to more people is a critical part of our mission at Harrison.ai, and as we emerge from the pandemic that mission is more important than ever," Aengus Tran, co-founder and CEO of Harrison.ai, said in a statement.

"With our model and methodology now proven across multiple clinical areas, we are in a position to expand to new clinical areas and deliver on our mission with the support of our investors and partners."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.