China automotive chip maker Semidrive raises $154m

Semidrive Technology, a specialist semiconductor manufacturer for the automotive industry, has raised RMB1 billion ($154 million) in Series B funding led by Pro Capital and V Fund.

Other investors include Matrix Partners China, CTC Capital, Vertex Ventures China, and domestic battery manufacturer CATL.

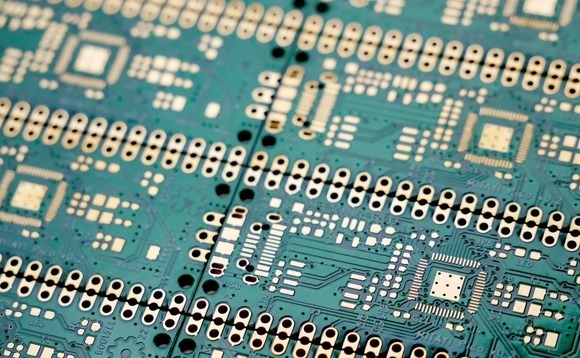

Founded in 2018, Nanjing-based Semidrive focuses on high-reliability and high-performance automotive system on a chip (SoC). SoC integrates all or most components of a computer. As carmakers move towards centralized domain architecture, it is seen as the single most powerful electrical component of a vehicle.

The company has released nine SoC solutions for smart cockpits, autonomous driving, central gateways, and microcontroller units (MCUs). In April, upgrades were introduced across the entire product range. Semidrive has also launched an open autonomous driving platform, which helps customers run tests on chips.

The company, which has R&D centers in Shanghai and Beijing, claims to have filled the gap in the Chinese market for high-end SoC. In March, against the backdrop of a global chip shortage, it received orders totaling one million units for delivery over the next 12 months. Chinese carmakers cannot source these chips from overseas suppliers.

"Semidrive represents our first investment in the intelligent automotive industry value chain. Smart car chips and autonomous driving algorithms are two important parts of the industry, and in the past three years, Semidrive has achieved mass production across a variety of products," said Chenhao Xu, a partner at Pro Capital.

He added that Semidrive has the potential to become a global leading automotive chip company.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.