CMC leads $123m Series E for China noodle shop chain

CMC Capital has led a Series E funding round of nearly RMB800 million ($123 million) for Hefu Noodle, a Chinese noodle restaurant chain.

ZWC Partners also came in as a new investor, while Tencent Holdings and Longfor Capital – an investment unit of Hong Kong-listed property developer Longfor Group – re-upped. Tencent and Longfor led a RMB450 million Series D for Hefu last November that also featured Meridian Capital.

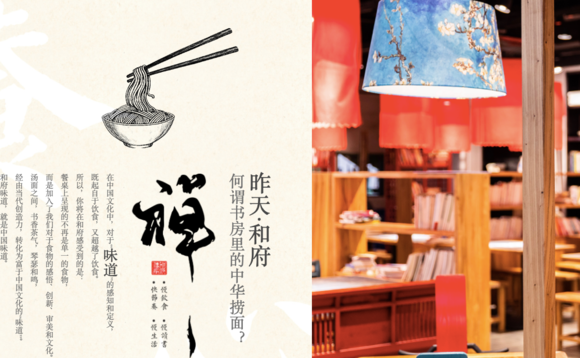

Established in 2013, Hefu's brand aesthetic is inspired by Zen Buddhism. Its restaurants are decorated like ancient Chinese study rooms, and it advocates "slow fast food," encouraging customers to take their time to enjoy meals.

The founding team has a background in consumer electronics, and they combined the traditional aesthetic with a modern approach to supply chain and business process management. Prior to opening its first store, Hefu had established a network of centralized kitchens capable of supporting 1,000 outlets and implemented digital systems to connect front, middle, and back-end functions.

As of June, there were more than 340 outlets nationwide. The goal is to reach 450 this year, doubling the pace of expansion seen in 2020, with a new store opening about once every two days. Average monthly turnover per store is RMB55,000, while the average customer spend is RMB45 per head – said to be high for China's catering industry.

Hefu has posted annual revenue growth of 50% for "many years," according to a statement. It was among the first catering brands in China to recover from COVID-19, with single-store sales returned to pre-pandemic levels in the second half of 2020.

The company is developing sub-brands, including Xiao Nian Xiao Jiu, which launched in April in Shanghai targeting young urban consumers and featuring a wider variety of dishes and beverages. There will be 50 outlets by the end of the year. Hefu has also entered the retail space, rolling out 20 direct-to-consumer products available via e-commerce platforms.

The new funding will be used to improve industry supply chains, brand building, establishing new business lines, and improving digital capabilities.

"China's catering industry is huge, but the chain penetration is low, so there is great development potential. With the growth of shopping malls, improvements in supply chain infrastructure, and increasing store-level informatization, the conditions are right for the emergence of a new generation of catering giants," said Alex Chen, a partner and CIO at CMC.

CMC has more than $2.5 billion in assets under management across US dollar and renminbi-denominated funds. Its most recent US dollar vehicle closed last year at $950 million. The firm backs companies – based in China or with a strong China growth angle – across the media and entertainment, technology, and consumer spaces. Hefu is its first investment in the catering space.

The Series E takes Hefu's funding since inception to approximately RMB1.7 billion. Tiger Cub Funds, Wuhan Zhonghe Ventures, and Wangju Capital provided a RMB30 million Series A in 2015. A year later, Trend Capital led a Series B round of undisclosed size. Juele Fund and Tiger Cub were responsible for a Series C round in 2017, according to AVCJ Research's records.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.