China drug development outsourcer raises $70m

Zhenge Biotech – a Shanghai-based contract development and manufacturing organization (CDMO) for large molecule drugs – has raised $70 million in Series B funding led by Qiming Venture Partners and IDG Capital.

CMB International, Lyfe Capital, and GT Capital are among the re-upping investors, according to a statement. They are joined by several government-related investment entities, such as Shanghai Financial Development Investment Fund, a Chinese Academy of Sciences fund, and Shanghai International Group's Guofang Capital.

Lyfe led a $51 million Series A in March 2020 and Zhenge claims to have raised $125 million in total funding to date. The new capital will go towards the construction of a commercial production base in the Shanghai Free Trade Pilot Zone.

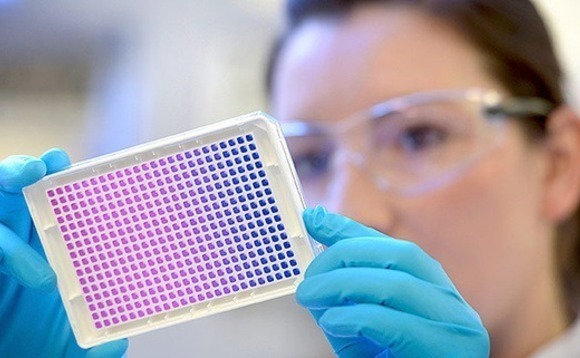

Established in 2017, Zhenge provides CMC (chemistry, manufacturing, and control) services to pharmaceutical companies. It has completed more than 100 projects, serving 80 corporate customers. Drug types covered include monoclonal antibodies, bispecific monoclonal antibodies, antibody-conjugated drugs (ADC), fusion proteins, and vaccines.

More than 90% of drugs currently available are small-molecule treatments, but large-molecule products, also known as biologics, are rising in popularity and importance. Biologics research has been at the forefront of development in recent years. Large-molecule drugs are classified as proteins and more difficult to develop than small molecules, which are identical and easy to manufacture.

WuXi AppTec is the runaway leader in China's pharmaceutical R&D outsourcing space, but service offerings vary across the industry. An increasing number of players have sought to become more integrated, combining contract research organization (CRO) and CDMO functions.

Earlier this month, CDMO player Thousand Oaks Biopharmaceuticals received a RMB400 million ($61 million) Series C round, while Yaoyanshe, a CRO targeting novel drugs, raised RMB600 million across two rounds last year. Frontage Holdings, another CRO player, raised HK$1.61 billion ($205.1 million) in a Hong Kong IPO last year. Qiming is among its backers.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.